Bank of Cyprus posted first-half losses of €126 mln, of which a hefty €100 mln was booked in the second quarter alone with the CEO attributing the downfall to its Project Helix aimed at reducing non-performing loans and selling off toxic portfolios.

“During the second quarter, we generated total income of €143 mln and a positive operating result of €56 mln,” CEO Panicos Nicolaou said in a statement issued to the Cyprus and London stock exchanges.

“The underlying result for the quarter was a profit of €4 mln and the overall result a loss after tax of €100 mln, including the loss on Project Helix 2 of €68 mln and loan credit losses of €21 mln for potential future NPE (non-performing exposures) sales.”

Nicolaou said the bank granted €689 mln in new loans in the first half of the year with 98% of its new exposures in Cyprus since 2016 currently performing.

New lending in the second quarter dropped 47% from the first quarter to €238 mln, impacted by the COVID-19 lockdown, imposed after March 10.

“We reached agreement for the sale of €900 mln NPEs in Project Helix 2 earlier this month. We further reduced our NPEs organically by €279 mln in the first half and completed the sale of €133 mln NPEs in Project Velocity 2.

“These combined de-risking actions have reduced NPEs in the first six months by €1.3 bln. Overall, since the peak in 2014, we have now reduced the stock of NPEs by €12.4 bln or 83% to €2.6 bln and our NPE ratio is now reduced to 22% on a pro forma basis.”

Nicolaou said the sale of NPE portfolios will continue.

He said the bank’s capital and liquidity position “remains good and in excess of our regulatory requirements”.

“As at 30 June 2020, our capital ratios (IFRS 9 transitional) were Total Capital ratio of 17.9% and CET1 of 14.4%, both pro forma for Helix 2.

“We continue to operate with significant liquidity surplus of €3.9 bln.”

Deposits at €16.3 bln were broadly flat quarter on quarter.

Nicolaou added that the focus remains on improving operational efficiency.

“Our cost to income ratio stood at 57%, whilst total operating expenses for the second quarter of the year were reduced by 18% year on year, enabled by our digital transformation programme which continues to progress well.

“Currently, 72% of our customers are digitally engaged and 83% of total transactions are performed through digital channels, up by 5 p.p. and 9 p.p., respectively, year on year.

“We are now better positioned to manage the challenges resulting from the impact of the ongoing COVID-19 crisis and to support the recovery of the Cypriot economy.”

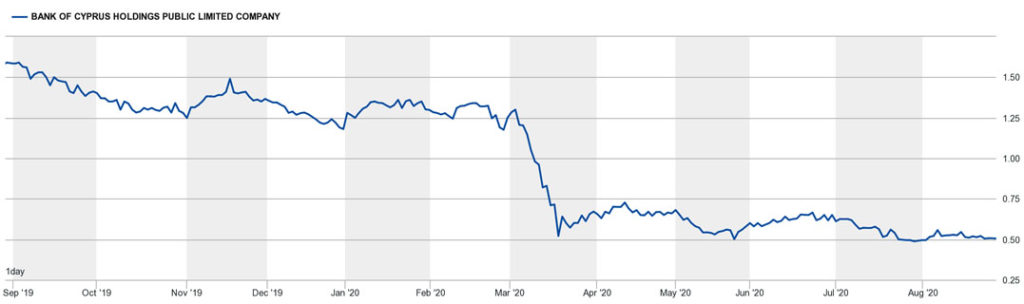

The bank’s share price closed on Thursday at 50.5c, dropping to the same level as on March 18, struggling to rise.