The impact of the COVID-19 pandemic continued to play a significant role in declining IPO activity in the first half of 2020, according to the EY quarterly report, Global IPO trends: Q2 2020.

Overall, Q2 saw a decline in initial public offerings from Q2 2019 across all regions by deal numbers and for the Americas and EMEIA by proceeds.

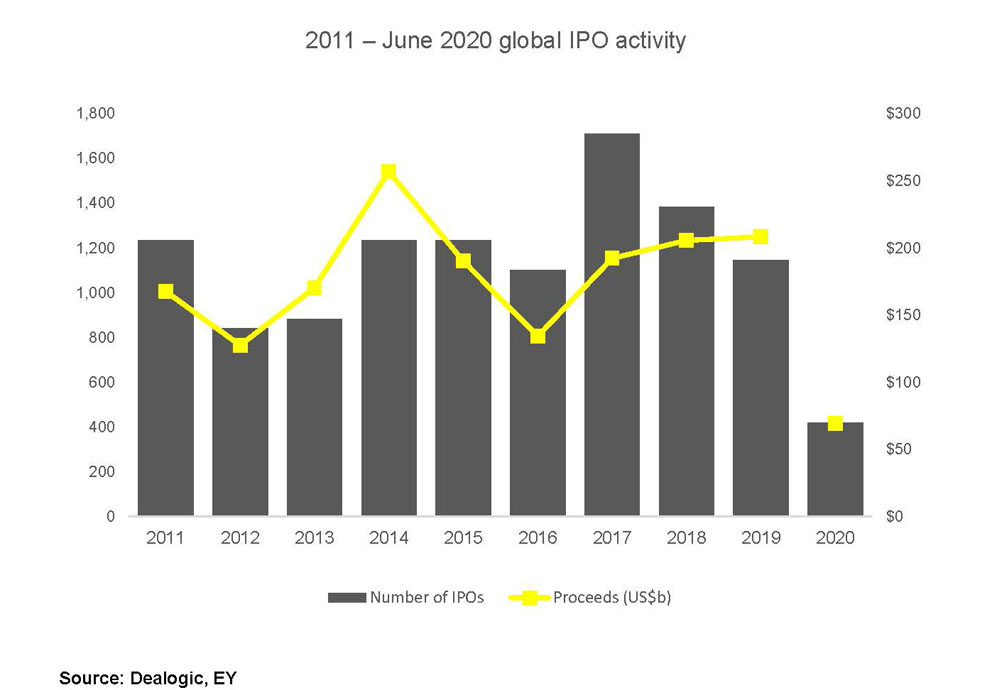

The EY report said that global IPO activity slowed dramatically in April and May, with a 48% decrease by volume (97 deals) and a 67% decrease in proceeds ($13.2 bln) compared to April and May 2019. This dragged down 1H 2020 regional activities compared with 1H 2019, and overall year-to-date deal volume (419 deals) and proceeds ($69.5 bln) decreased 19% and 8%, respectively, from YTD 2019.

Despite a late flurry of deals in June, global IPO activity was sluggish on Americas and EMEIA stock exchanges, while Asia-Pacific IPO activity increased.

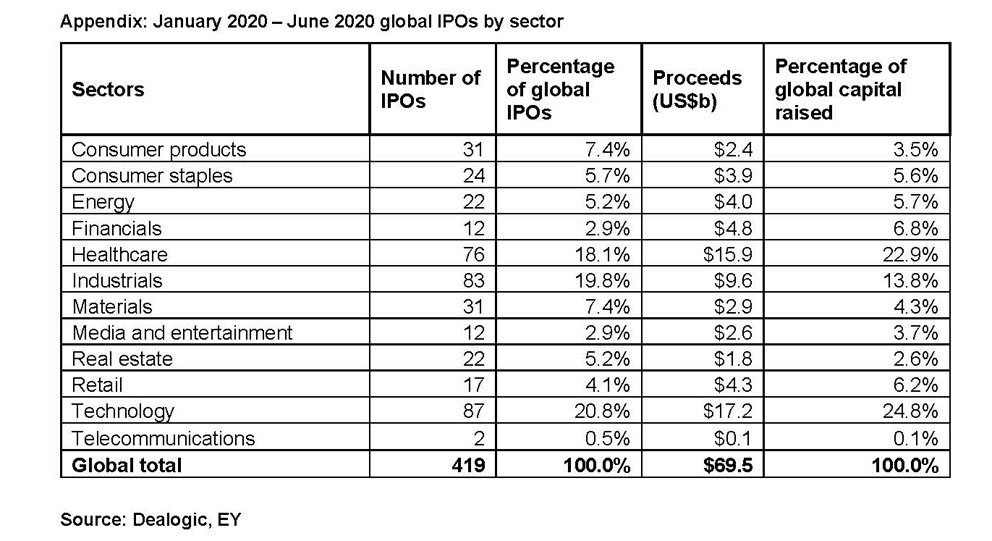

The technology, industrials and health care sectors dominated so far in 2020. Technology saw 87 IPOs raise $17.2 bln, industrials saw 83 IPOs raise US$9.6 bln and healthcare had 76 IPOs that raised $15.9 bln.

After a strong start to 2020, YTD IPOs (42) and proceeds ($7.8 bln) declined 47% by volume and 48% by proceeds in Europe, as the COVID-19 pandemic significantly curtailed IPO activity from March through to May. In the Middle East and North Africa (MENA), IPO activity was down 11% by volume (8 IPOs) and down 43% by proceeds ($0.9 bln) YTD 2020. There was also one IPO each on the Malawi and Bangladesh exchanges, which raised $29 mln and $7 mln, respectively.

US exchanges still accounted for the majority of IPOs in the Americas in the first half of 2020, with 79% by deal volume (64 deals) and 91% by proceeds ($22.3 bln); this included five unicorn IPOs.

The healthcare and technology sectors continued to have the highest level of IPO activity in the US, representing 55% and 25% by deal volume, respectively. Healthcare dominated in proceeds ($10.2 bln), contributing 46%, from 35 IPOs.

Asia-Pacific exchanges accounted for four of the top five exchanges by deal volume and three of the top exchanges by proceeds. Globally, by proceeds, NASDAQ led YTD 2020, followed by the Shanghai Stock Exchange and Hong Kong Stock Exchange. By deal volume, Shanghai, Hong Kong and NASDAQ markets led the way.

“Given the COVID-19 outbreak and its negative impact on economic activities, in the short to medium term, governments around the world will continue to implement policies and stimulate economies against rising unemployment,” the EY report said.

“At the same time, central banks will inject more liquidity into the financial systems. Both actions bode well for equity markets and IPO activity in 2H 2020.”

Explaining the research findings, Stelios Demetriou, Partner and Head of Strategy and Transactions of EY Cyprus said: “After a strong start in Q1 2020, IPO activity declined between March and May in most markets, because of the economy lockdown.”

“During that period, we witnessed a new remote IPO environment, with virtual investor meetings, and shortened roadshow periods to limit the short-term market risks. However, we began to see a strong rebound in June, with stock prices rebounding and market sentiment improving.

“Today, with rebounds in main indices, markets are adaptable, resilient and supportive for IPO activity to pick up in the second half of 2020, especially in technology, pharmaceuticals and life science sectors,” Demetriou concluded.