By Hussein Sayed, Chief Market Strategist at FXTM

Investor sentiment kicked off the week on a positive note, with equities in Asia resuming last week’s rally, the US dollar remaining soft against its major peers and commodity prices on the rise.

Attitude towards risk over the past week has been boosted by further re-opening of economies, falls in Covid-19 infection rates in developed countries and Europe increasing its fiscal and monetary support.

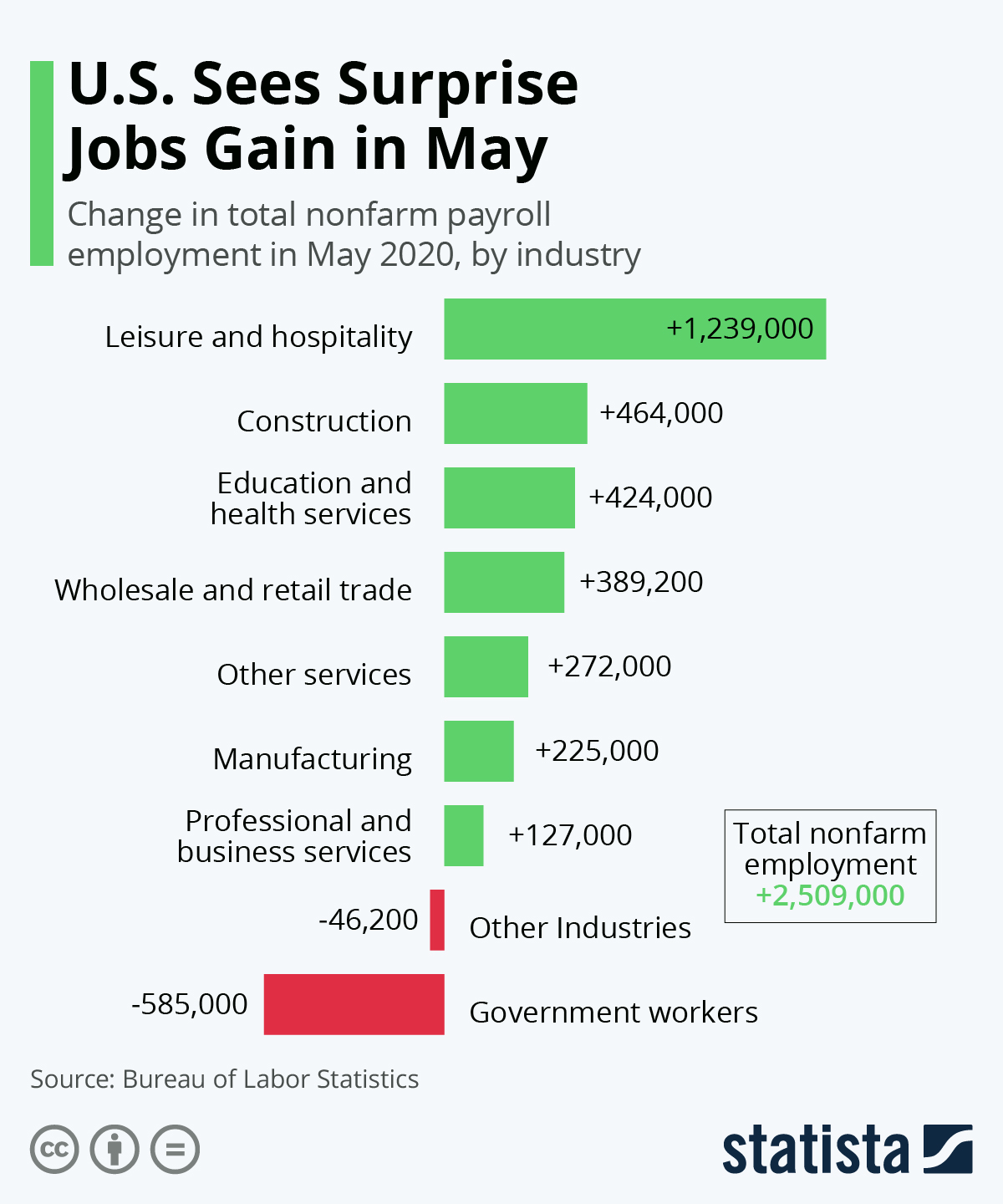

However, it was Friday’s US jobs report which provided most of the upside after the headline print smashed expectations by more than 10 million, an astonishing figure and another new record.

Markets were expecting job losses of 8 million for May after a record loss of 20.5 million in April. Instead the US economy added 2.5 million jobs. The report certainly supports the view that the economy may experience a faster recovery than most have anticipated.

However, caution must be exercised as there are several red flags.

Firstly, the labour department said unemployment would have been 3% higher if not for misclassification errors. Secondly, the coronavirus pandemic has also led to lower reporting from businesses to government surveys, hence disruptions in the data. And if activity does not return fast, small businesses may not keep employees on their payroll much longer, having already spent the grants provided by the government. We will need at least two to three non-farm payroll (NFP) releases to get an accurate view of the US labour market.

The S&P 500 has almost completed a round trip for the year with the index only 1% lower from where it started 2020. However, this time it is not only being led by Big Tech and biotech firms, but the most beaten-up sectors such as airlines and leisure are also surging. That is what you’d like to see as a signal of a broader economic recovery, but the big question remains – are we truly witnessing a broader economic recovery or is it a false signal from equity markets?

Whether current fiscal and monetary stimulus efforts can truly fix the economic damage wrought by the virus remains unknown. What is understood at this stage is there is enough liquidity to support the bullish scenario case. However, when looking at fundamentals there has never been such a disconnect between stock price levels and projected earnings.

While protesters around the world are seeking changes in equality, what we see in the markets is a further widening of inequality where ‘the rich get richer and the poor get poorer’. That is evident in the largest US companies as several have become larger than they were before the Covid-19 pandemic, while small and medium-sized businesses are suffering. Failing companies are also on the rise with US commercial bankruptcy filings under Chapter 11 jumping in May by 48% from a year earlier.

Perhaps at a later stage, investors will need to re-think how the social unrest will impact government policies in the form of regulations, taxes and antitrust laws. But this is not an imminent risk for the current bull market and we will leave this discussion for another time.

In the current environment, it does not seem to matter anymore if fundamentals match up with equity prices. Fear of missing out (‘FOMO’) and simple greed may continue to push risk assets higher and many of those who have remained on the sidelines will still want to participate.

It would be wise to consider buying portfolio insurance whether it’s in the form of Gold, put options or another form of hedge, until it’s clear that the economy is truly recovering at the pace suggested by risk asset classes.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius