Cyprus will suffer one of its deepest economic contractions due to COVID-19 lockdown measures, but the easing of restrictions will enable a short, sharp, shock.

This is according to a complex basket of economic indicators, as compiled by the University of Cyprus from local and international data.

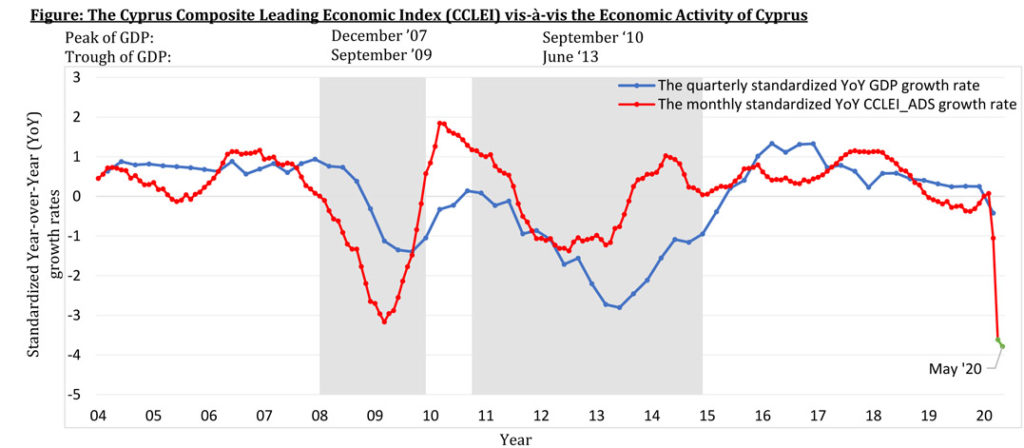

The Cyprus Composite Leading Economic Index (CCLEI) compiled in cooperation with Hellenic Bank, showed one of its most significant year-over-year (YoY) reductions in April (7.6%) reaching a level of 104.4 (based on the latest data), said the monthly UCY report.

This was almost double the fall recorded in the previous month’s report.

The CCLEI Index, based on the Aruoba, Diebold, and Scotti (ADS) (2009) model approach (CCLEI_ADS), recorded one of its most significant negative year-over-year growth rates in April, “due to the temporary lockdown and restrictive economic activity measures both domestically and internationally,” the monthly report said.

Within the domestic economic environment, preliminary estimates suggest significant negative YoY growth rates in March and April 2020 for both the volume of retail sales and electricity production.

Among the restrictive measures taken, the ban on entry into Cyprus resulted in zero tourist arrivals and, consequently, no income from tourism.

Nevertheless, with the lifting of measures and the gradual transition to normalcy, the Economic Sentiment Indicator in the euro area, which recorded its strongest monthly decline in April 2020, appears to show some signs of improvement in May, the authors of the CCLEI said.

“At the same time, increased credit card transactions combined with low year-over-year oil price growth rates in April and May signal the gradual restart of the economy.”

The “closing” of the Cyprus economy led to one of the most important negative year-over-year pressures of the CCLEI Index in April, which is expected to be particularly noticeable in the second quarter of 2020.

However, this significant impact will begin to weaken with the gradual lifting of restrictive measures, as shown by the flash estimate of the index in May.

The flash estimate is constructed based on the euro area Economic Sentiment Indicator (ESI), the Brent crude price and the high frequency data of the volume of electricity production for May, while its other components are estimated by the ERC based on the latest available information in a series of various indicators.

Earlier, the CCLEI recorded a year-over-year (YoY) decrease of 4.0% in March reaching a level of 112.9, following decreases of 2.1% in February, and 1.5% in January (based on updated data).

This was attributed to sudden interruption of business activity and the parallel reduction in consumption as a result of the coronavirus pandemic.

Both tourist arrivals and credit card transactions showed strong year-over-year declines in March and April, with preliminary estimates suggesting negative growth for both the volume of retail sales and electricity production, while the YoY growth rate of authorised building permits was expected to remain negative.

The April edition of the CCLEI noted that the “free fall” crude oil prices had a positive effect on the index, but this was offset by the reductions in all other components.

Therefore, estimating the flash estimate of the CCLEI Index for April (as shown in the diagram with the green line), is presented to record a dramatic decrease anticipating the significant contraction of the Cyprus economy.

Two senior economists at the University of Cyprus who published a position paper on May 1 arguing extensive research based on real-time data is necessary to give out the right projections about the economy, had said that Cyprus GDP could drop between 7% to 14%, in an extreme scenario.

They argued that with no tourist arrivals expected at least through to June, the impact on the tourism sector could be annual losses of between 20% and 80% and suggested issuing ‘innovative’ indicators based on weekly data.

“In the current environment of great uncertainty, and the conditions fluctuating drastically, it is highly doubtful the techniques and methods which rely on monthly and quarterly historical data, which are often published with great delay, are in a position to capture the rapid fluctuating conditions in time,” the two economists argued.