By Hussein Sayed, Chief Market Strategist at FXTM

The good news is that economies around the world are starting to reopen, suggesting some activity will begin to recover compared to the full lockdown experienced in April. However, will there be a price to pay for the easing of restrictions?

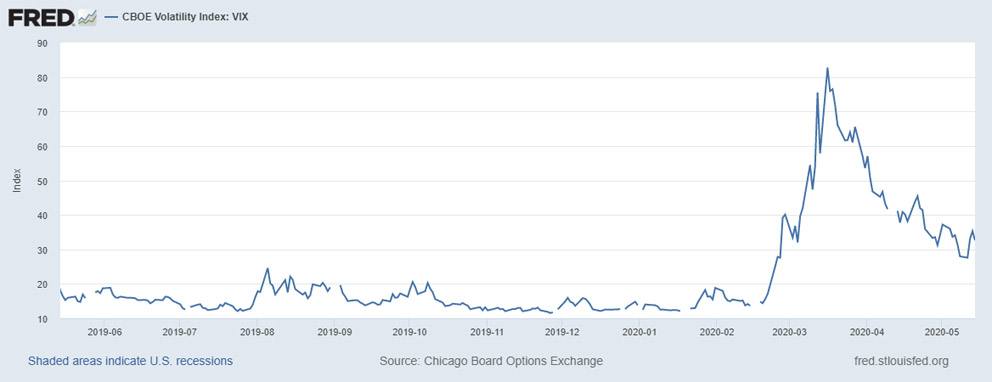

Hopefully not, but when looking at how investors traded the VIX last week, they seem to be expecting some turbulence ahead. Often referred to as the ‘fear gauge’, the index climbed 14% last week to settle around 32 in the biggest upside move since late March. Futures on the index also moved higher with July contracts rising 6.5% and closing the week at 32.6.

In his latest appearance, Federal Reserve Chairman Jerome Powell said the economy could recover steadily through the second half of the year under the condition that there is no second wave of the coronavirus. But when listening to the head of the National Institute of Allergy and Infectious Diseases, Dr. Anthony Fauci and other experts, many warn that a second wave is inevitable if US states ease restrictions too quickly. According to Powell, there needs to be a vaccine for the economy to fully recover and that may be more than a year away.

Trying to say with a high degree of confidence where the markets will be headed in the coming weeks is mission impossible. The current state of the economy is already priced in, with the existing monetary and fiscal measures taken. So, do not expect to see big moves with each economic data release. It is better to monitor the rate of growth in Covid-19 infections as this might provide a better indicator for market moves.

The other risk factor investors need to keep an eye on is US-China tensions.

After US Secretary of State Mike Pompeo last week blamed China for covering up the origins of the virus, White House trade advisor Peter Navarro is now accusing China of using travelers to seed the virus in Milan and New York. Whether Friday’s move to block global chip supplies to blacklisted telecom company Huawei will restart another tit-for-tat tariff war remains to be seen, but the odds are now increasing. At this stage that’s the last thing investors want to see.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius