By Ivanka Pittelkau

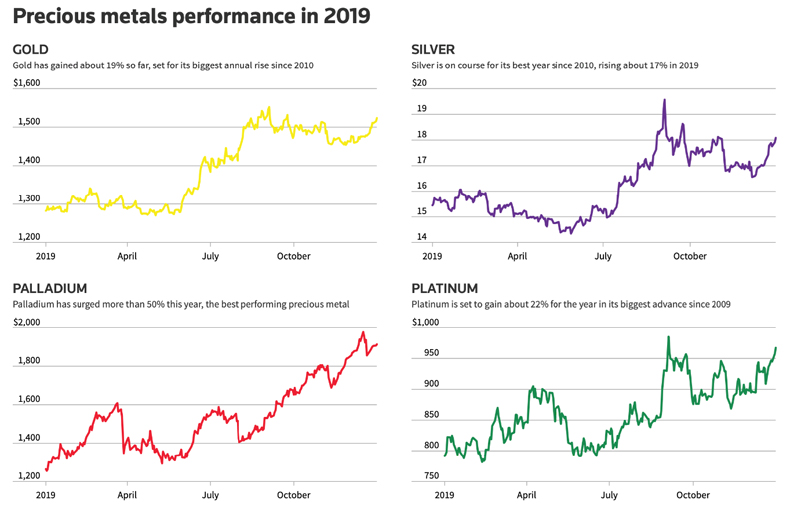

Precious metals were on a glistening run in 2019; Palladium extended gains for the fourth straight year, in fact, it surged more than 50% in 2019 alone.

Platinum had its best year since 2009 gaining about 22% throughout. Gold closed the year with its biggest annual rise since 2010, some 19%.

Last but not least, Silver, despite still being highly undervalued, also experienced its strongest gains since 2010, rising about 17% during the year.

Price direction and thus predictions for the precious metals is heavily influenced by geopolitics and market reforms, and 2019 was finally a great year for precious metals, experiencing some solid gains again after investors turned to safe-haven assets to protect their portfolios.

And 2019 was dominated by Brexit woes and the US-China trade tensions, though progress has been made on both fronts.

The US Federal Reserve cut interest rates three times during the year. Mario Draghi of the European Central Bank delivered free monetary stimulus just before Christine Lagarde took over his position.

Anti-government protests in Hong Kong, that began in June last year, have basically wrecked Asia’s financial centre.

Uncertainty on the way forward for Hong Kong has been weighing on equities and burdening both the local and possibly even the global economy, keeping markets cautious.

Persistent global economic headwinds and concerns about slowing global growth have been positive for precious metals, especially gold.

Political unrest, trade war risks, stagnating growth in the US, Europe and Japan continue to be market hazards, as are the negative interest rates and the ever-increasing global debt-level.

2020 will be an interesting year as far as how the geopolitical events continue to be handled, unexpected new events that will influence the markets, the US elections and whether President Trump will remain on his throne, the direction of the Federal Reserve, a potential equities collapse, performance of the USD as the world’s reserve currency, to name a few.

Whilst we have gathered some predictions of what 2020 will hold in terms of price developments for the four main precious metals, any forecast or projection should be looked at with a high level of scepticism.

Whereas some industry veterans are feeling very bullish in their assumptions, we would agree more with the conservative approach; best trades could certainly be in commodities with precious metals taking the lead, and Platinum potentially becoming the favoured precious metal with greatest returns.

Generally speaking, precious metals will rise over the year, but a hugely spectacular increase is not anticipated.

Some normally cautious bank analysts are looking for an end-2020 Gold price of around USD 1,600 which seems plausible at this moment in time.

Others expect the price of gold to reach a level of USD 1,675 based on gold thriving on uncertainty which is the state that the global economy is currently facing. Taking several views into consideration, gold could stand at USD 1,625 by year-end, that is up about 10%.

Silver has been underperforming gold for years and most analysts see silver performing better than gold in percentage terms in 2020, however not so hugely. The likely price of silver could be up around 12% reaching USD 19 per ounce. Keep an eye on the silver-to-gold ratio.

The fundamentals for Palladium to keep its upward run in the first half of 2020 are strong.

It is currently trading at double the value of Platinum which may, however, be signs of it entering a bubble phase. As such, there may be signs for a reverse substitution during the second half, of platinum for palladium. Platinum may go up by about 20% reaching levels around USD 1,150 versus an 8% increase for Palladium which could lock in at USD 2,100 by the end of the year with potential highs of around USD 2,400 during the year.

With 2020 already here, market uncertainly and volatility high, it is important to focus more on capital protection, as an investor, than eyeing those grand returns in the prevailing economy.

Here is a list of possibilities investors are currently hedging their portfolios against or will potentially need to with safe-haven assets such as gold, silver and PGMs (platinum group metals) in their investment portfolios:

- China’s inability to comply with the terms of the “Phase One” trade deal with the U.S. and thus reviving the trade war.

- Continued or worsening lower interest rate environment and global indebtedness, quantitative easing / monetary printing resulting in increased borrowing and the inability to earn money.

- Deteriorating corporate profits due to slower economic growth, as has been the case since 2014.

- Global economic growth remains weak and spreads into the US.

- A market liquidity crunch caused by credit-related events.

- President Trump and the USA 2020 elections.

- De-dollarisation and the search for an alternative reserve currency; crypto or even gold, for example.

- Currencies close to zero in value (especially over Gold à lost 80% since 2000)

Key statements of the biggest financial institutions from Bloomberg’s “Almost Everything Wall Street Expects in 2020” and in summary, for the next 12 months: “Investors are going to earn less. A lot less, probably.”

Deutsche Bank Wealth Management

Slowing economic growth argues against outright commodity exposure, but the case for real assets plus a likely moderation in dollar strength points to opportunities in gold. History suggests that a rising U.S. budget deficit can be associated with upward pressure on the gold price. Our end-2020 forecast for the gold price is $1,550 per ounce.

Pictet Wealth Management

We think moderation in global growth and elevated political and economic uncertainty will support defensive currencies like the yen and Swiss franc as well as gold.

Amundi Asset Management

If, as we believe, the global recession will be averted, the outlook for commodities remains benign. Gold will continue to be seen as a powerful hedge against geopolitical risks.

Standard Chartered

Sentiment in commodity markets has been heavily influenced by external factors such as U.S.-China trade tensions. Prices in many markets have improved recently, but further gains in 2020 could be constrained by U.S. protectionism. Copper continues to be viewed as a proxy for global growth. Oil market fundamentals appear balanced. Nickel and palladium have been the most resilient to global trade tensions. We view near-term price weakness as a long-term buying opportunity for gold.

JPMorgan Chase & Co

The BCOM Index will probably decline by nearly 6% through year-end. The third-wave manufacturing bounce in the global macroeconomy should deliver some lift in cyclical commodities in early 2020 but it will more closely resemble the relatively constrained economic environment of 2012, as constrained Chinese growth and idiosyncratic supply factors will likely prevent a repeat of 2016 reflationary bull market across commodities.

In oil, Brent is expected to decline and to reach $55.60 per barrel in the fourth quarter, 2020. In precious metals, similarly to 2016, a backdrop of growth uplift alongside a Fed explicitly on hold should be inherently positive, but not uber-bullish.

At the time of writing, the price of the main precious metals stood as follows: Gold USD 1,522.28, Silver USD 17.92, Platinum USD 977.33, and Palladium USD 1,942.45.

Ivanka Pittelkau is Precious Metals Consultant at Liemeta ME Ltd, a provider of physical storage of precious metals at its prime location in Liechtenstein as well as trade services of precious metals, mainly gold, silver, platinum and palladium.