July’s tech selloff sent shockwaves through the market as investors shifted away from mega-cap stocks and high-growth sectors in favour of smaller-cap stocks and sectors more likely to benefit from potential interest rate cuts.

This huge shift in market sentiment caused considerable damage to the Magnificent Seven companies, erasing trillions of dollars from their stock values. Although most started recovering from the July hit, their stock values are still much lower than just two months ago.

According to data presented by Stocklytics.com, the combined market cap of the tech giants hit $15.6 trln last week, or $1.2 trln short compared to July.

Microsoft, Alphabet, Meta worst hit

After adding a whopping $4.8 trln to their combined stock value in the first half of the year, and 2024 being close to becoming a record year for their growth, the Magnificent Seven had a rough month in July.

The US government’s expanded export restrictions on AI chips to China, expectations of future interest rate cuts, which caused investors’ shift to sectors more sensitive to interest rates, like real estate and financials, combined with broader geopolitical tensions and disappointing earnings reports from tech giants Alphabet and Tesla, have caused a massive tech selloff, erasing trillions of dollars from the Magnificent Seven’s stock values.

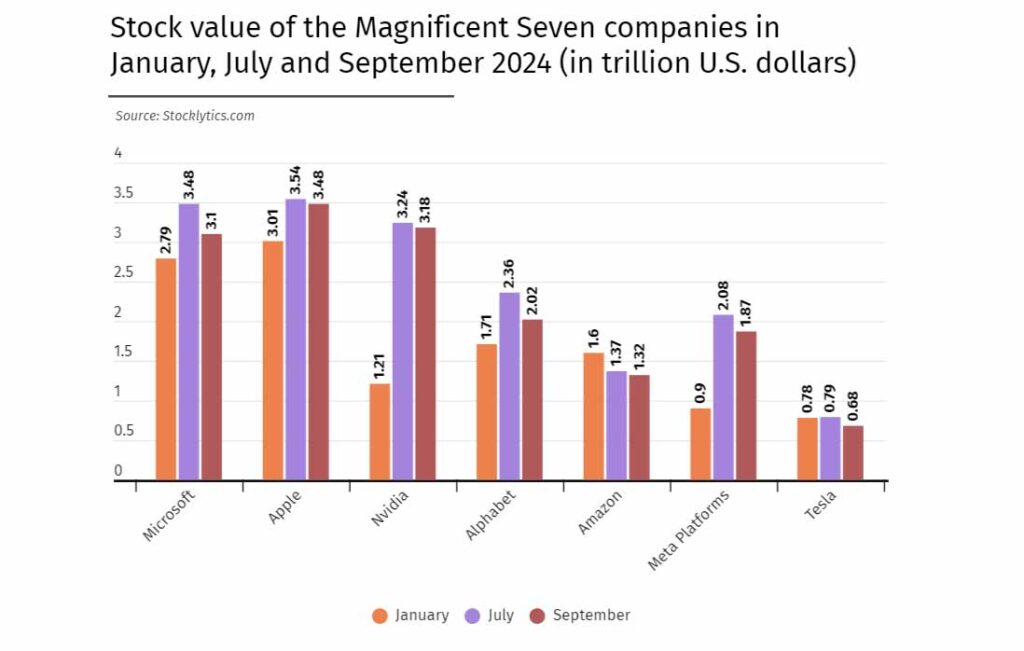

In July, the combined market cap of Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms and Tesla amounted to $16.8 trln, a value just slightly under the GDP of the world’s second-largest economy, China. Since then, this figure has plunged by $1.2 trln to $15.6 trln as of last week.

In July, the combined market cap of Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms and Tesla amounted to $16.8 trln, a value just slightly under the GDP of the world’s second-largest economy, China. Since then, this figure has plunged by $1.2 trln to $15.6 trln as of last week.

Although all eyes were set on Nivida since the selloff started, the AI giant successfully bounced back after the July hit.

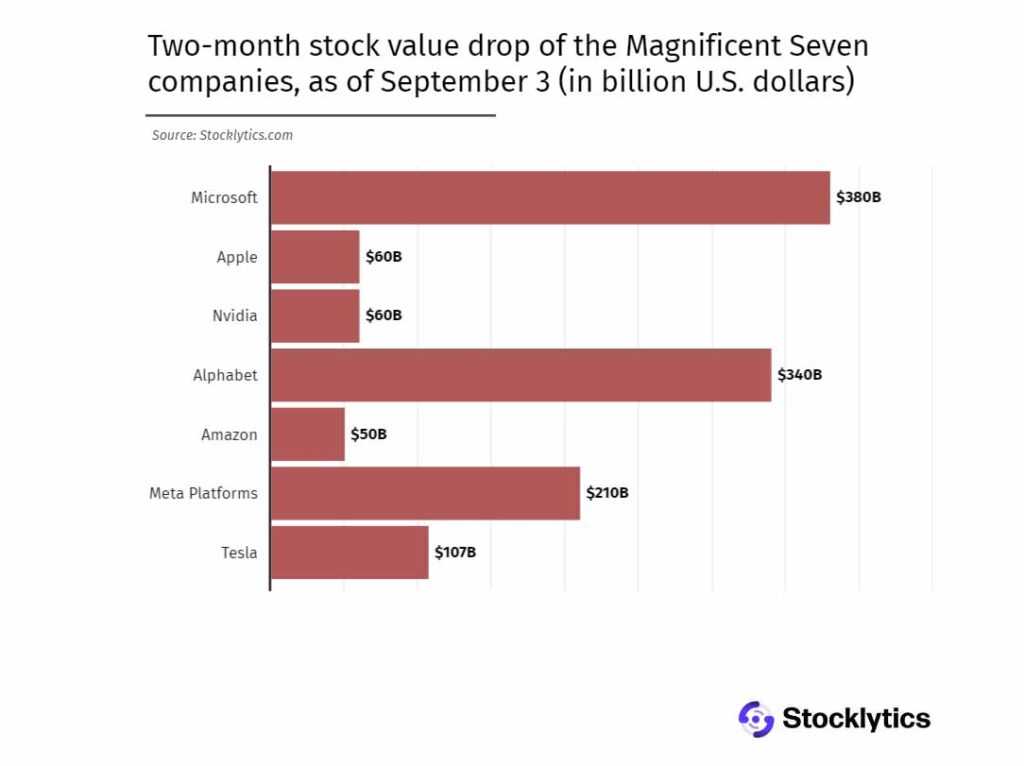

Statistics show Nvidia’s stock value hit $3.48 the first week of September, still $60 bln less than in July, while the company`s year-to-date gain is still a staggering $1.97 trln. Apple and Amazon suffered similar losses, with their market caps being $60 bln and $50 bln below July levels, respectively.

Statistics show the most valuable car producer, Tesla, saw a $107 bln stock value drop in the past two months.

On the other hand, Microsoft, Google-parent Alphabet and Facebook-parent Meta are recovering much slower. Meta’s market cap is still $210 bln below July levels, however, the company’s year-to-date gain is still a considerable $411 bln.

Alphabet lost $350 bln in value over the past two months, while Microsoft suffered an even worse hit, with the tech selloff erasing $380 bln from its market cap. In July, the stock value of the world’s second most valuable tech company stood at $3.48 trln, and now it’s $3.1 trln.

Combined stock value higher than Japan, Germany, India, UK GDP

Although a $1.2 trln drop in less than two months is enormous, the valuations of the Magnificent Seven companies are still quite shocking compared to entire economies or the GDP of the world’s leading markets.

Statistics show the combined stock value of Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms and Tesla is still worth more than the automotive, healthcare, and energy industries.

Furthermore, with a combined stock value of $15.6 trln, the seven tech giants are worth more than the combined GDP of Japan, Germany, India and the United Kingdom, and roughly two trillion dollars short compared to the GDP of the world’s second-largest economy, China.