By Naeem Aslam

European markets and US futures are trading higher while investors wait for the two most important events to unfold, one of which will shape trading activity for the rest of the month.

On Wednesday, the major US stock indices were mostly unchanged. The S&P 500 closed near the flat line, the Nasdaq Composite closed lower by 0.2%, and the drag in the tech index was very much due to the sell-off in the tech stocks, in turn, due to poor earnings.

Uber and Shopify both announced earnings that fell short of expectations.

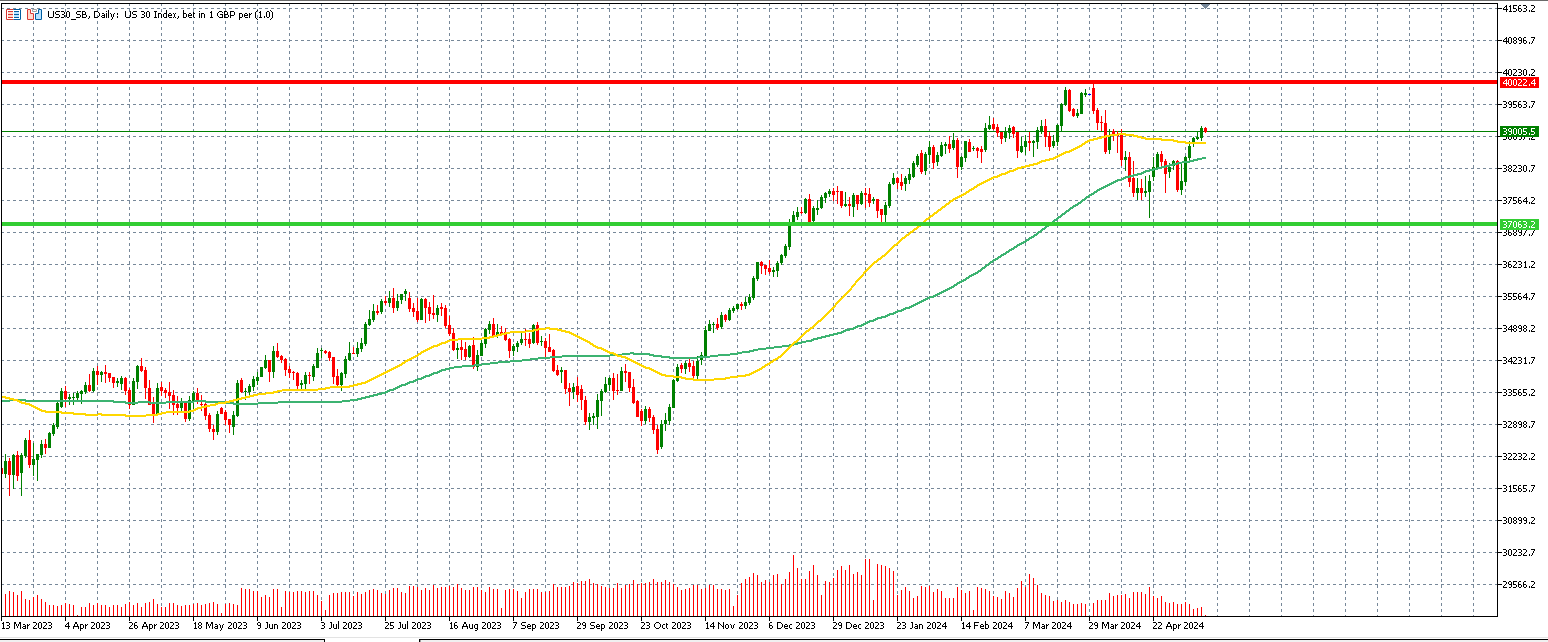

The Dow Jones chart below shows that the bulls are taking control of the price action as the price has moved above its 50 and 100-day SMA on the daily time frame which is bullish for the price.

Airbnb will be the one to watch, as the stock price tumbled over 8% Wednesday with the company delivering weak guidance.

Important to note is that Airbnb’s weak guidance represents the fact that consumers do not have enough disposable income, which means that most of the leisure sector and consumer discretionary sector could underperform this summer.

A downturn in this sector could lead to a slowdown in economic activity, as fewer consumers will have disposable income to contribute to the economy. This could result in a significant impact on the central bank’s policy, which has a significant influence on disposable income.

Bank of England and sterling

Looking at the sterling-dollar price chart, it appears that the price is ready to rise because it has formed a pattern known as a reverse head and shoulder, which is strongly associated with a bullish move.

However, if we look at the fundamentals, technical price analysis makes less sense. This is because the Bank of England is under tremendous pressure to lower the interest rate as the UK’s economy is in dire condition due to the cost of living crisis and self-inflicting injuries.

Inflation seems to have improved, but any further improvement and inflation seems questionable as the economy is experiencing serious slowdown – it would not be a stretch statement that the UK economy is the worst in Europe.

Going into the meeting, many traders believe that the Bank of England will move the hope needle further. It is a given that the BoE will not change interest rates on Thursday, but the shift in votes among the MPC members could improve sentiment.

The forecast is for all votes to remain hawkish, which means no one is going to vote for a rate cut despite economic weakness. However, if we do see a shift, market players will like that message as a positive, and the FTSE 100 may rise, while sterling could fall further against the dollar index.

Unemployment claims

Later in the day, we will also have the US unemployment claims data.

The non-farm payrolls left traders on edge, as it sent a clear message that the labour market has begun to weaken.

If we see a number that shows a weakness in the US labour market, the equity market will take the bad news as good news, and we could see a rally. This is because traders are going to take that data as a sign that the Fed is being pushed into a corner, and they will have no choice but to begin the process of cutting rates sooner, rather than later.

Gold

The precious metal posted losses on Wednesday, but on a weekly basis, the price is back in positive territory, which shows that bulls are coming back.

This is mainly due to the movements in the dollar index and expectations around the Fed’s monetary policy.

In terms of economic data that could move the price action, it will be the US unemployment claims on Thursday and the preliminary consumer sentiment data print, which is due Friday.

A weakness in unemployment claims, as well as a weakness in consumer sentiment, would add pressure to the dollar index and move the gold price higher. This is, again, mainly due to the fact that market players will take the bad news as good news, and we may see a shift in the Fed’s narrative.

Oil

The OPEC cartel’s potential move in its meeting on June 1 is the most important fundamental. If we look at the option markets and the current price action, it is pretty much a given that traders have already expected the production output to remain the same until the end of this year.

The demand and the amount built up in oil inventories are what matter most. In addition, we are also entering the refinery maintenance period, which would add further pressure on the inventory built up and may not be the best scenario for oil prices.

There is also a growth story in the US and China.

On Saturday, we are going to see the CPI number, and an improvement in that data should positively influence growth, which would have a positive influence on prices.

For now, the main potential move for oil prices would be to grind to the downside, or, in the best-case scenario, a consolidation pattern.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.