Nicosia rejects Chevron’s improved omtimisation plan

Cyprus has chosen to play hardball with the partners of the country’s first gas discovery, the 3.5 tcf Aphrodite offshore gasfield, made back in 2011, informing partners Chevron, Shell and Israel’s NewMed, that their latest proposed revisions to the field’s 2019 development plan, “are not acceptable.”

The Middle East Economic Survey reported that Chevron submitted its latest plans after Nicosia last August rejected the previous proposals which essentially amounted to a tearing up of the 2019 plan. Nicosia said the 2019 plan is binding.

According to the MEES report, Chevron said that the plan, inked before it took over as operator with its 2020 purchase of Noble Energy, is uneconomic. Its proposed 2023 revisions lop $1 bln off the expected cost but also envisage lower output from the Cyprus exclusive economic zone (EEZ).

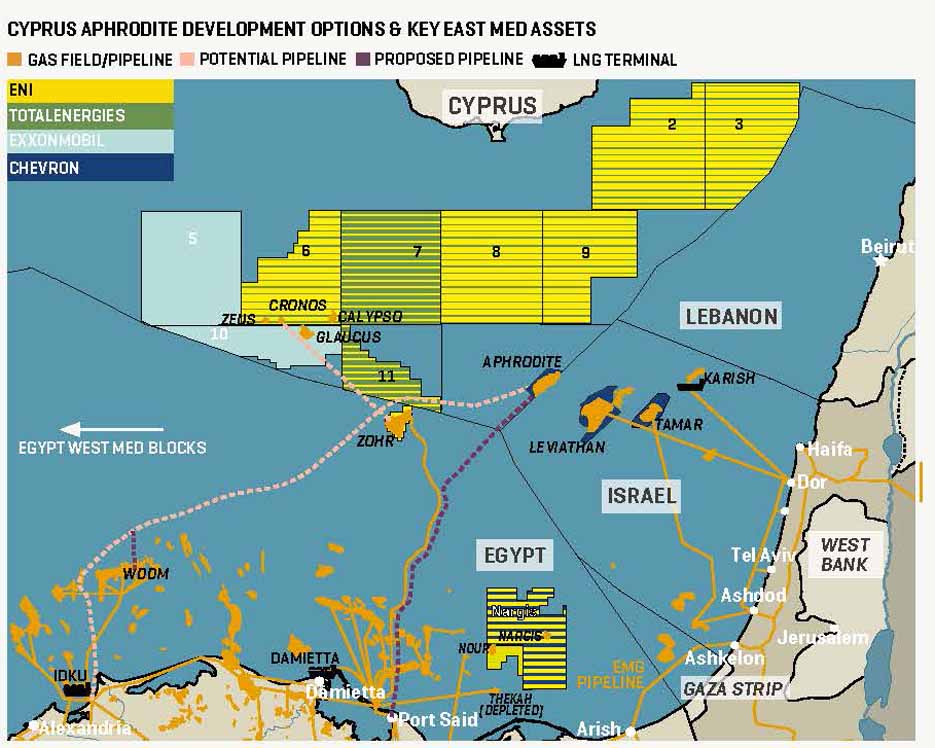

The 2019 plan would connect a floating production unit (FPU) situated above the field via subsea pipeline to Idku on Egypt’s coast some 480km away, with five wells to produce 800 mln cfd.

Chevron’s 2023 revisions envisaged ditching the FPU, cutting the number of wells to three with output of 650 mln cfd and shorter tieback to Shell’s West Delta Deep Marine (WDDM) facilities offshore Egypt.

The 2019 plan obliged Chevron and its partners to achieve a number of development milestones including launching front-end engineering design (FEED) by 7 November 2023. As this deadline approached, and it became clear it would not be hit, a flurry of claims and counter-claims ensued, the MEES report explained.

Ultimately, Chevron agreed in December that it would re-file an “optimised” development plan that would hew much more closely to the 2019 version, including maintaining the use of an FPU which had apparently been Nicosia’s key demand in negotiations.

On 28 March, Chevron presented Nicosia with optimisation options which proposed retention of the FPU, but an envisaged output figure of between 400-600 mln cfd from four wells, lower still than that under the May 2023 proposals.

Savings would be made by a shorter subsea pipeline of 240 km to processing facilities at Port Said making use of the same pipelay ‘corridor’ as that linking Eni’s giant deepwater Zohr field to shore.

With Zohr output currently running at just 1.9 bln cfd (and falling), as against 3.2 bln cfd capacity, Chevron perhaps envisages that it could tap unused processing capacity for the giant Egyptian field.

With Zohr output currently running at just 1.9 bln cfd (and falling), as against 3.2 bln cfd capacity, Chevron perhaps envisages that it could tap unused processing capacity for the giant Egyptian field.

However, Eni also has its eye on this, with tie-back to Zohr the favoured development option for Cronos and its other Cyprus Block 6 discoveries.

Frosty reception

MEES understands that though Chevron mooted the option to Nicosia of combining development of Aphrodite with that of 2.5tcf Cronos, Eni gave these plans a frosty reception.

Chevron was expecting to secure improved terms to make “the FPU case investible” after last year’s A3 appraisal well at Aphrodite indicated a 20% decrease in the field’s original gas in place figure. This was a non-starter for Nicosia which feels that it already substantially sweetened terms under the 2019 plan.

The Aphrodite partners “intend to examine the implications of the letter received from the Government of Cyprus, and the possible courses of action available to them in this regard,” NewMed said.

MEES understands that Nicosia was particularly dismayed by the substantially lower revenue implications of the lower output projections under Chevron’s revised plans. Chevron in turn said the 2019 plan is unlikely to meet its return-on-investment requirements.

Whether Nicosia’s 30 April letter represents a final decision or a negotiating position remains to be seen, the MEES report said.

It added that the US major could walk away from the project, leaving it in breach of contract, while Nicosia is threatening to issue the partners with three months’ notice that they plan to revoke the license.

“It’s not in anyone’s interest to see this situation descend into litigation. Cyprus is trying to show that it won’t be messed around, but it risks souring relations with Chevron and potentially Washington with its approach,” a source close to the talks said.

“Some quarters in Cyprus don’t believe that Chevron has any intention of developing Aphrodite and that their only concern is to hold on to the asset for as long as possible. But despite that, they [Cyprus] are willing to give them [Chevron] a chance to do the right thing and adhere to the 2019 plan,” a Cyprus industry source told MEES.

Chevron’s optimal option for development of its EastMed gas reserves would likely be to first press ahead with full field expansion at Israel’s nearby Leviathan, which it also operates, and develop Aphrodite later as a tie-back to Leviathan when output there begins to decline. Given that this would likely set back Aphrodite development by a decade it would no doubt be a non-starter to Nicosia.

“Cyprus’ newfound sterner approach to the negotiations with Chevron could be linked to the hopeful news around Cronos, but that isn’t to say it hasn’t taken talks with the Aphrodite partners seriously over the last twelve months in an attempt to exhaust all possibilities,” the industry source said.

Signalling both sides’ wishes to develop Cronos sooner rather than later, Eni CEO Claudio Descalzi flew into Nicosia on 30 April to meet with President Nikos Christodoulides.

“The meeting was the occasion to discuss a shared fast-track approach that allowed the [Cronos-2] appraisal well to be drilled [in late 2023] while evaluating multiple development scenarios,” Eni said.

“Highlights of the preferred solutions to efficiently meet domestic as well as regional and European energy priorities in the short and longer period have been outlined,” the Eni statement added.

Nicosia had been hoping that Descalzi’s visit would bring with it an official development plan, but MEES understands the Eni CEO instead merely repeated verbally that its preference is to tie back Cronos to the Zohr gas field, some 90km away in Egyptian waters.

Cairo is desperate to get its hands on as much gas as possible with its own output in decline and rising demand seeing the return of blackouts since last summer.

“Nicosia might be relieved that its gas fortunes are not all dependent on Chevron and the fate of Aphrodite, but they need to be wary that Eni’s willingness to move quickly on Cronos is related to the huge disappointment, or even failure at Zohr,” the source said.

However, Cairo’s hopes of achieving first gas by 2026, or even 2025, are set to be thwarted, with Chevron deciding that a further appraisal well is needed and this unlikely to be drilled until next year due to lack of rig availability, MEES concluded.