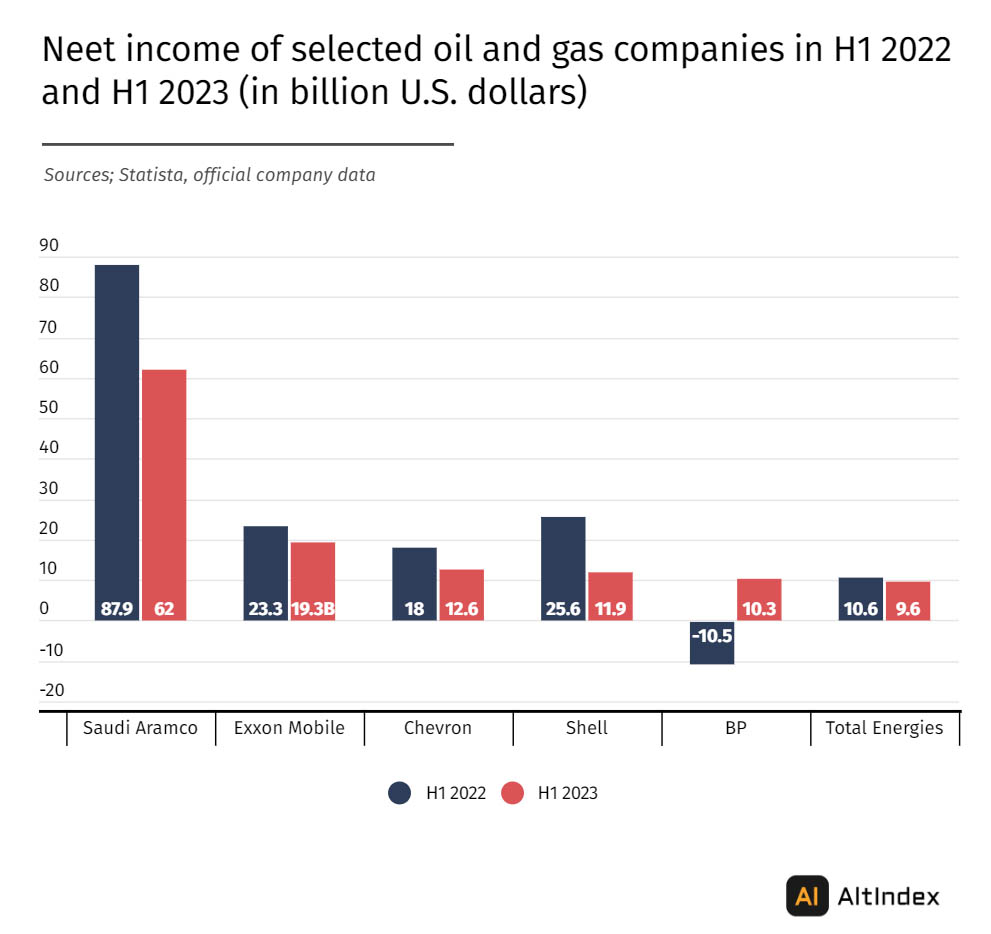

The world’s largest oil and gas companies saw their combined profits slump by a massive $29.2 bln year-on-year, as a sharp decline in gas demand and lower oil prices significantly cut down profits.

Although the world’s largest oil and gas companies are still raking in massive profits, their earnings have significantly dropped since last year’s highs, according to data presented by AltIndex.com.

According to Statista and the official company data, the world’s largest oil company, Saudi Aramco, made $62 bln in net income in the year’s first half, down 30% compared to the same period a year ago. However, the Saudi Arabian oil giant has still managed to dwarf its international competitors.

As the second-largest oil producer globally, the US-owned ExxonMobil saw only one-third of Saudi Aramco’s earnings. Statistics show the company earned $19.3 bln in the first half of 2023, down 17% from the first six months of 2022.

Another US oil giant, Chevron, saw even bigger earnings drop. According to the company’s official data, Chevron’s net profit dropped 30% year-over-year, falling from $18 bln in H1 2022 to $12.6 bln in H1 2023.

Shell suffered biggest loss

Still, that was nothing compared to the loss of Shell.

The British-Dutch company suffered the biggest earnings drop of all companies on this list, with its profit falling by a massive 54% year-over-year. Between January and June, the company made $11.9 bln in net income, down from $25 bln in the year-ago period.

Statistics also show that British-owned BP is the only company on this list with better first six months results than in 2022.

After exiting its stake in the state-controlled Russian oil and gas company Rosneft last year, BP suffered a $25 bln worth financial hit and ended H1 2022 with a net loss of -$10.5 bln. However, the company recovered since then and ended H1 2023 with $10.3 bln in net profit.

After exiting its stake in the state-controlled Russian oil and gas company Rosneft last year, BP suffered a $25 bln worth financial hit and ended H1 2022 with a net loss of -$10.5 bln. However, the company recovered since then and ended H1 2023 with $10.3 bln in net profit.

The French Total Energies saw its net profit drop by $1 bln year-over-year, falling from $10.6 bln to $9.6 bln.

Statistics show the six oil and gas giants made $125.7 bln in combined earnings in H1 2023, down from $154.9 bln in the same period a year ago.

Earnings drop, stock values rise

Although their net earnings dropped by an average of 30% compared to 2022, most of the energy giants saw their stock values increase this year.

According to the Macrotrends data, the combined market cap of Saudi Aramco, ExxonMobil, Chevron, Shell, BP, and Total Energies amounted to $3.14 trln in December. Ten months later, this figure stands at $3.43 trln.

Statistics show Saudi Aaramco saw the biggest growth of 16%, with its stock value rising from $1.88 trln to $2.19 trln in this period. Shell and BP follow, with a 10% and 2% market cap growth in the past ten months.

The Macrotrends data also show that Chevron is the only company on this list whose stock value has significantly dropped year-to-date.

In December, the market cap of the US oil and gas company stood at $343 bln. Since then, it has fallen by more than 30% and hit roughly $317 bln last week.