A clean-energy start-up, ready by 2030, aims to become the world’s longest subsea interconnector, supplying Britain with about 10.5 gigawatts of electricity, enough for 7 million households, or about 8% of the UK’s power needs.

The project, called Xlinks, is in the fundraising stage and might not even require public money, according to investors.

Simon Moorish, the company’s CEO and a former EY executive, said this week: “The support of the UK Government is crucial in realising our ambition to supply British households with secure, affordable, and green energy in the face of the growing climate crisis.”

All this is thanks to 20 hours a day of solar and wind power from Morocco.

Britain enjoys five major interconnectors despite exiting the EU, with a sixth in the pipeline – Viking, connecting to Denmark.

The future of Europe’s electricity needs is in its 400 interconnectors, made more urgent after Russia closed the tap of natural gas supplies when it invaded Ukraine and the Union imposed sanctions, effectively cutting off all economic ties.

The EU has fast-tracked its ‘Green Deal’ vision and hastened plans to reduce carbon emissions by switching to clean energy sources, such as solar, wind, hydro and other generation.

Across the continent, Cyprus became the focus of electricity grid developers and operators when, in 2011, the deadly Mari blast decimated the state utility’s primary power plant.

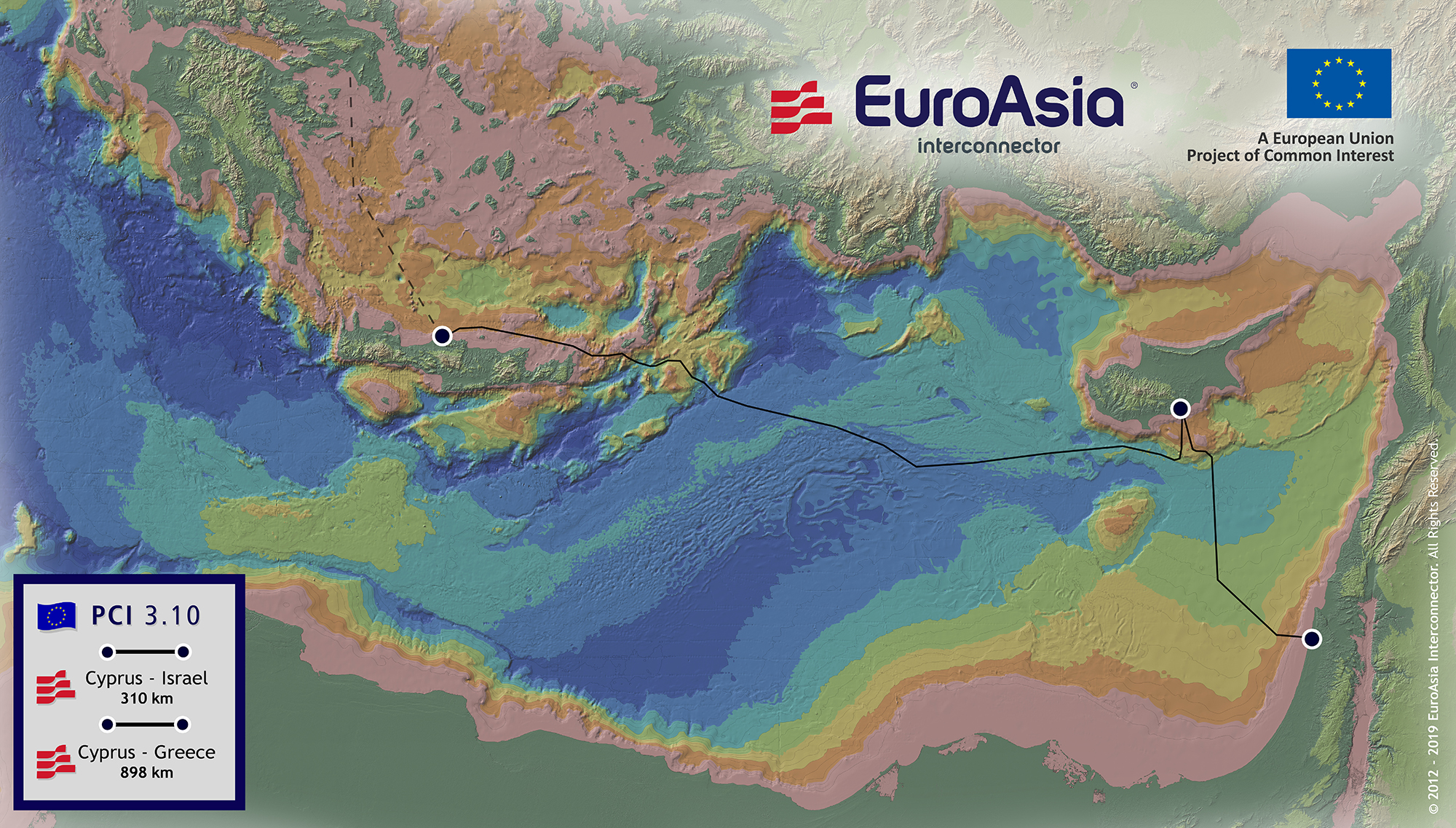

As a result, a visionary project was conceived, the EuroAsia Interconnector, which, when ready in late 2027 or early 2028, will be the “longest and deepest” subsea link, a title it will keep until Xlinks come online.

The EuroAsia has a design capacity of 2 gigawatts and will cost a tenth of the Morocco-UK’s €20 bln.

It already secured €657 in Commission grants and a further €100 mln from the RRF recovery and resilience fund to make the EU economy clean and more competitive, as it will end Cyprus’ energy isolation.

EuroAsia will also help the local PV power producers, popping up all over the island, to export their excess supply westward to Crete and from there to continental Europe at attractive rates.

Or eastward to Israel, which is bracing for an energy crunch by 2027, with new power stations needing far longer to be built despite the discovery of vast offshore natgas deposits.

Over a third of the EuroAsia cost is in the bag, with bankers and investors waiting on the sidelines to fund the rest.

Even the US International Development Finance Corporation has expressed interest in participating in the project.

Unlike the UK government backing Xlinks, EuroAsia is frowned upon.

Unfortunately, the European Investment Bank relied on a flawed study to claim that EuroAsia is economically not viable, comparing the round-the-clock subsea cable to electricity batteries, depleted after four hours.

This is comparing apples to oranges.

Yet, the Cyprus government fell for the trick and was misled into believing the misinformation. Unable to admit that its decision was wrong, despite the incumbent President being part of the administration of the past decade that supported the project, the Energy Ministry has resorted to a face-saving tactic, commissioning a package of studies reviewing the sustainability, geopolitical and due diligence of the project promoter.

These studies have now been delayed for unknown reasons.

Furthermore, after Greece’s IPTO declared its intent to take a stake in the company on the cheap, the project’s viability is no longer doubted.

Effectively, the ministry doubts all the studies, financial plans and surveys conducted by the biggest names in the world.

It clearly does not believe that global giants Nexans and Siemens can realise such a challenge.

It also mistrusts the Commission for greenlighting such an infrastructure.

Instead of celebrating the milestone project that places Cyprus on the world map, it has decided to shoot down the only energy project that can become a reality.

It makes one wonder whose interests the current government promotes – Cypriot consumers or those of other nations, including China’s ambition to meddle in European energy plans.