As the UK braces for a record heatwave, with scorching temperatures throughout Europe, US and Asia, experts warn that urgent investment is needed in sustainable goals to combat climate change, a crisis on the planet’s doorstep.

The worst heat wave in Europe is causing an avalanche of devastating wildfires across Spain, Portugal, Croatia and France; a heat dome has formed over the southwest and the central US, smashing temperature records; and almost 90 cities in China are living under heat alerts.

On Monday, the Cyprus Met Office issued a second yellow weather warning for high night-time temperatures and unusually hot weather for the mountains.

Maximum temperatures on Monday will rise to 39 degrees Celsius inland (the seasonal average), while the mountains will swelter under 32°C.

The BBC reported the UK could have its hottest day on record this week, with temperatures forecast to reach 41C.

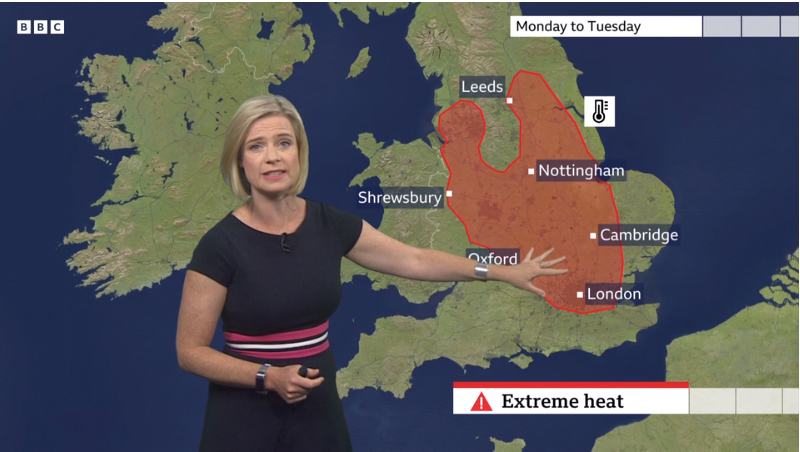

The UK Met Office issued a red extreme heat warning on Monday and Tuesday in much of England, from London and the southeast to York and Manchester.

The highest temperature recorded in the UK was 38.7C in Cambridge in 2019.

High temperatures are also forecast across the UK – with amber warnings in the rest of England, all of Wales, and parts of Scotland.

London was one of the hottest places in the world on Monday, with temperatures soaring above Western Sahara and the Caribbean before cooling on Wednesday.

“The consequences of years and years of outrageous inaction from politicians on the climate crisis are now being laid bare,” said Nigel Green, chief executive and founder of deVere Group, a leading financial advisory and fintech.

“Data shows heatwaves have been on the rise in recent years, yet governments around the world are either unwilling or unable to funnel the resources necessary to try and tackle the problem head-on.”

The deVere CEO said trillions of dollars are needed, and private money must be unlocked and mobilised in the battle to mitigate the worst effects of human-created climate change.

Need to step up

“For this to happen, all sectors within the financial industry need to step up, including financial advisories, insurance firms, banks, wealth and asset managers, investment companies, fintech groups, banks and auditors.

“If we fail on this, the level of finance will not be available, nor at the pace necessary, to halt the catastrophic effects of global warming.”

Green also criticised some within the financial advisory industry who fail to urge clients to invest in environmental, social and governance (ESG) orientated investments.

“Those in our industry who are looking to weaponise or politicise ESG investing by branding it as ‘woke virtue-signalling’, amongst other things, are placing themselves and their companies on the wrong side of history,” he wrote in a column in FT Adviser.

“The so-called ESG backlash is misguided and shallow.”

He added that clients’ investment strategies would also benefit.

“Funds investing in entities with robust ESG credentials have outperformed their benchmarks over recent years.

“From a risk management point of view, including these companies in your portfolio is, clearly, a sensible decision to take.”

Last year, before the COP26 climate summit, deVere Group became one of 18 founding signatories of the UN-backed Net Zero initiative, the international alliance of global finance companies that will help accelerate the transition to a net zero financial system.