By Moody’s Analytics

U.S. recessions are ultimately a loss of faith: consumers lose faith that they will have a job and pull back on their spending, and businesses lose faith that there will be demand for the good or service they produce, and they lay off workers.

A vicious, self-reinforcing cycle takes hold.

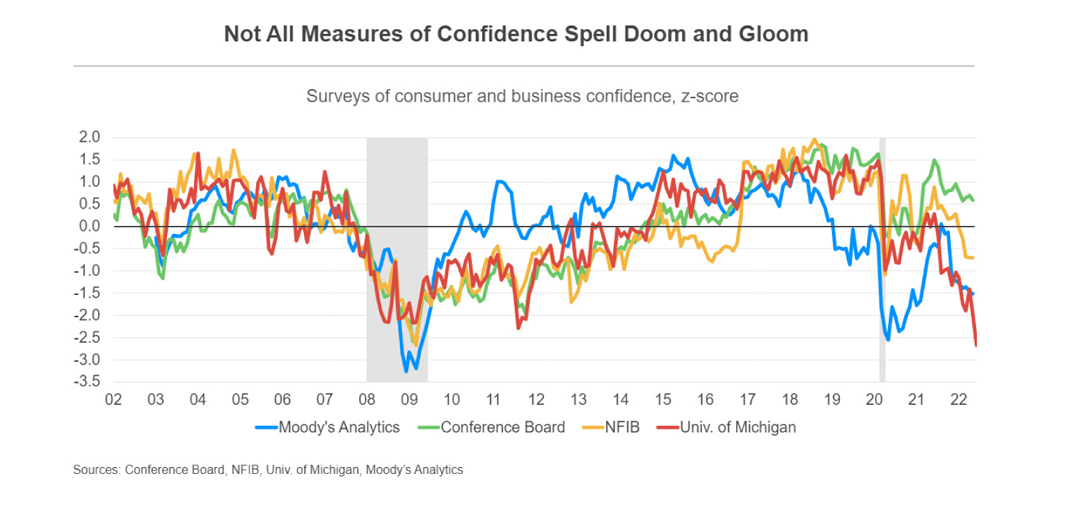

There has been a decline in small business confidence and some but not all measures of consumer sentiment.

This has fanned concern about a recession. To highlight this, we calculated z-scores. These measure the standard deviations above or below the mean for the quits rate in healthcare.

The z-score shows how many standard deviations each of these surveys of consumer sentiment is from its mean.

The recent drop in the University of Michigan consumer sentiment index puts it well below its mean.

The NFIB small business optimism survey and our weekly global business confidence surveys are also lower than their respective means. The standout is the Conference Board consumer confidence index, which remains higher than its average. This measure of sentiment is sensitive to the health of the labor market, which is holding up well even as the economy has weakened.

Something that has garnered attention is the enormous decline in the NFIB small business optimism survey responses about expectations over the next six months. The net percentage of respondents expecting the economy to improve came in at -54%, compared with -50% in April.

Expectations have deteriorated noticeably during the past few months from -35% in February. Expectations for the economy to improve are by far the lowest on record.

That said, the situation likely is not as dour as it appears.

One reason is that businesses are saying one thing and doing another. Hiring and investment is significantly stronger than would be implied by the poor outlook from the NFIB survey.

We put more stock in what businesses do rather than say because some surveys, including the NFIB, can lean politically in one direction. Indeed, respondents to the NFIB’s survey tend to favor Republicans, which isn’t surprising, since Republicans have a tendency to be more pro-business than Democrats. In other words, the NFIB survey overestimates growth under Republicans and underestimates it for Democrats.

No good option for Biden on pump prices

President Biden is pushing Congress to suspend the federal gas tax for three months as elevated fuel prices pummel consumer sentiment and push household inflation expectations uncomfortably high. With Republicans largely against the idea, along with some Democrats, it is extremely improbable that the proposed gas tax holiday will ever see the light of day.

As a result, no change to the baseline forecast is warranted. Nevertheless, the ill-fated proposal shows just how few good options the White House has in its toolkit to lower gasoline prices in the near term.

A gas tax holiday, even if it were to pass Congress, would provide little relief for consumers. The president’s proposal would suspend the 18.4 cents per gallon tax on gasoline and the 24.4 cents per gallon levy on diesel and other fuels through September, costing the federal government at least $10 billion that would otherwise fund the construction, operation and maintenance of highways.

While this is not an insignificant amount for the Highway Trust Fund, which relies on revenues collected through these excise taxes, consumers might not even perceive the effect of a gas tax holiday, as the federal gas tax currently accounts for less than 4% of the nationwide cost of a gallon of gasoline.

Moreover, in practice, not all of the tax cut would filter through to consumers, as gasoline producers and retailers would pocket some of the reduction. According to the University of Pennsylvania’s Penn Wharton Budget Model, between 58% and 87% of three recently enacted gas tax holidays at the state level were passed on to consumers in the form of lower pump prices, with suppliers capturing the rest.

Risk of boosting demand amid lower supply

When inflation is as high as it is today, the federal government’s priority should be to do no harm. A gas tax holiday does not pass this test. A suspension of the federal gas tax risks boosting gasoline demand at a time when supply is constrained, thereby leading to higher pump prices and adding to inflation.

Domestic crude oil production is still below pre-pandemic levels, and refiners are already operating at full tilt. Therefore, the Biden administration would do better to focus on policies that improve the supply of energy rather than support its demand, but here too there are no silver bullets to bring down fuel prices meaningfully in the near term.

The U.S. is already releasing 1 million barrels of oil per day from the nation’s Strategic Petroleum Reserve, but it is not clear how effective the SPR is in stabilizing oil prices, particularly when expectations around geopolitical events are influencing prices.

Also, opening up more federal lands and waters to oil drilling would not immediately reduce the sticker shock at the pump, as it would take months for new oil wells to become productive. More important, there does not appear to be a regulatory lever that the administration can pull to encourage more investments by energy companies.

A clear majority of executives from exploration and production firms believe that investor pressure to maintain capital discipline is the primary reason publicly traded oil companies are showing restraint despite high prices, not government regulations.

Moody’s Analytics will continue to monitor policy proposals coming from the White House that seek to combat inflation. Outside of energy, the Biden administration can take further steps to boost the flow of immigration without congressional approval, which would lift the supply of labor and help prevent wage pressures from overboiling in the labor market.

Also, the administration is considering reversing some of the trade war tariffs instituted under former President Donald Trump, which would alleviate goods price inflation, though by how much is still unknown given the lack of details so far.