Stock Markets appear to have wiped out losses resulting from a challenging year marred by the economic effects of the coronavirus pandemic, with record gains alongside significant drops in certain sectors.

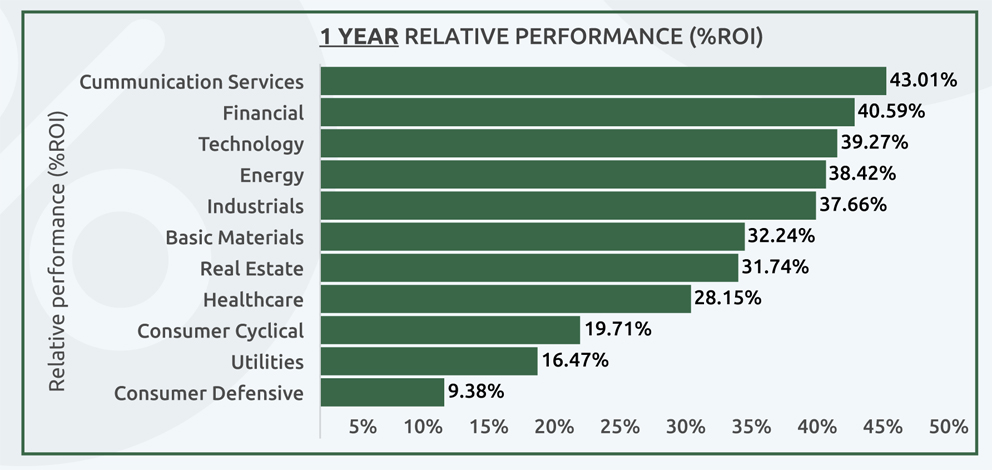

According to data compiled by the financial platform Finbold, all stock sectors’ one-year relative performance as of September 7 have generated a positive return on investments (ROI).

Communication services led with returns of 43.1%, followed by financials and technology at 40.59% and 39.27%, respectively. Interestingly, after being among the most hit sectors amid the pandemic, energy ranks fourth with returns of 38.42%.

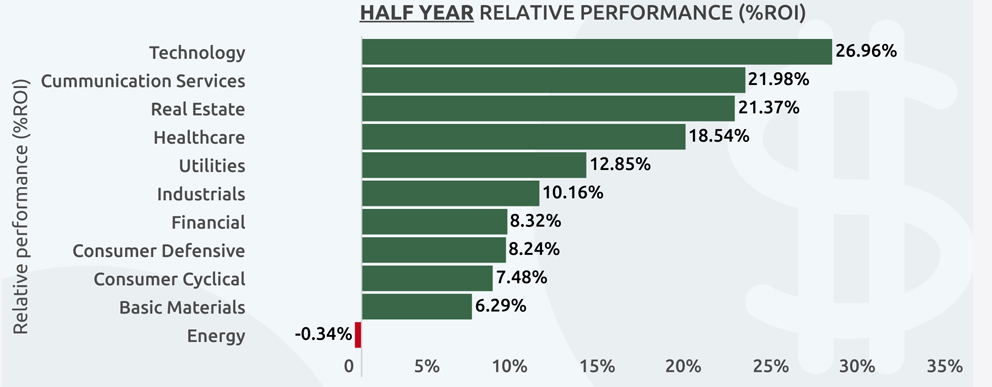

Similarly, under the relative half-year performance, only the energy sector recorded negative returns of 0.34%. Investors in the technology sector earned the highest returns at 26.96%, followed by communication services at 21.98%, with real estate accounting for 21.37% ROI.

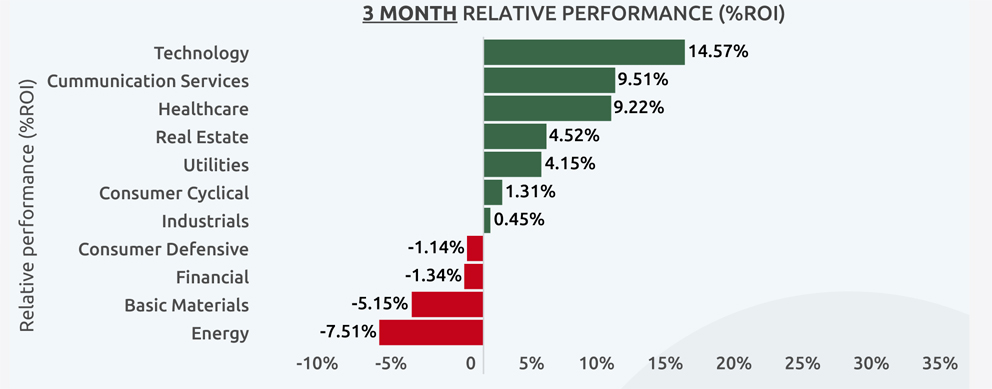

However, over the last three months, most sectors have wiped out the gains made over the past year. Technology holds the pole position at 14.57%, followed by communication services at 9.51%. Elsewhere, energy is the worst performer at 7.51%, according to data provided by Finviz.com.

All stock sectors green

The gains made by stocks in the past year come after the market was temporarily shaken in March 2020 when stocks plunged for about a month at the onset of the coronavirus pandemic.

However, despite the economy struggling, millions of people losing their jobs, and businesses getting shuttered, the markets took an exciting turn.

However, despite the economy struggling, millions of people losing their jobs, and businesses getting shuttered, the markets took an exciting turn.

The Federal Reserve stepped in with critical measures to avoid the free flow of the economy that resulted in the stock market sustaining its gains while supporting the financial markets. At the same time, Congress passed stimulus packages pumping trillions of dollars into the economy across multiple relief bills.

However, the gains extended to this year to a large extent after the Federal Reserve pledged to keep interest rates low for a long time, a scenario that favours stocks and corporate investment.

The institution resorted to cutting interest rates to near zero in mid-March and pumped more liquidity into markets.

Although the stock market was hitting new levels last year, it managed to stay on top despite fears that posed a threat to the gains made. For instance, the market stayed afloat amid the hostile political environment around the United States presidential elections.

Overall, one factor that stands out is that the past year’s recovery was in two phases.

Overall, one factor that stands out is that the past year’s recovery was in two phases.

The first entailed the tech stocks powered by a stay at home orders. Elsewhere, from the third quarter last year, the economic recovery saw companies in the energy sectors record profits that reflected on their stocks. The rollout of the coronavirus vaccine has directly impacted these stocks.

Furthermore, the technology sector has remained steady, propelling the market to new levels.

Notably, amid the pandemic, tech stocks relatively remained unscathed, with investors viewing firms in the sector as crucial beneficiaries from recent trends such as remote working and cloud computing, which rose to prominence. The industry helped people navigate the health crisis.

Economic uncertainty

Elsewhere, the stock market performance over the last three months reflects investors’ concerns. With rising inflation, the cost of living is up leading to investor fears directly impacting the stocks.

Notably, the technology sector remains on top with high returns mainly due to consumer behaviour changes emanating from the pandemic.

The market has been plunged with high volatility, with prices for certain stocks dropping. Amid the drop, the market usually presents an opportunity for investors to buy.

The market has been plunged with high volatility, with prices for certain stocks dropping. Amid the drop, the market usually presents an opportunity for investors to buy.

Furthermore, the economy has remained uncertain during the period due to the onset of new coronavirus cases from the Delta variant. The cases have resulted in uncertainty over the future course of the markets.

At the same time, the energy sectors appear to be returning to early last year levels mainly driven by the falling oil prices. The drop in prices emerges over fears of slowing growth alongside OPEC plans to begin phasing out production cuts.