By Lukman Otunuga, Senior Research Analyst at FXTM

Asian shares were mixed on Tuesday as oil prices rallied after OPEC+ abandoned output talks with no new date set for more discussions.

European stocks are trading lower, with investors not only keeping an eye on the developments in the oil market, but key economic data from the Eurozone and Germany. US futures are mixed with the cautious mood from Europe likely to infect Wall Street later Tuesday.

OPEC+ abandons meeting, what next?

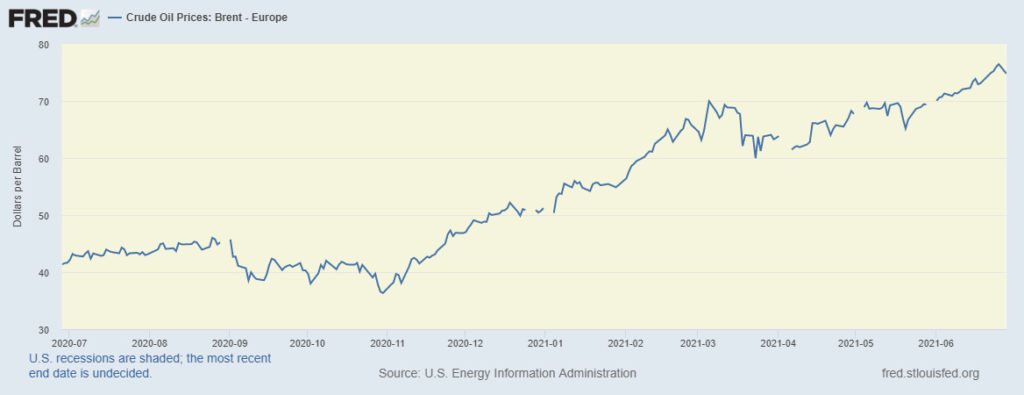

Brent crude oil prices punched above $77.50 Tuesday morning to the highest levels in three years after Monday’s talks between OPEC and its allies were postponed indefinitely amid rising tensions between the UAE and Saudi Arabia.

The key question is whether such a move will result in higher or lower oil prices in the medium to long term. If things are left in limbo with no deal reached, this may result in the group keeping output unchanged in August and the rest of 2021. Such a scenario could see higher oil prices.

The key question is whether such a move will result in higher or lower oil prices in the medium to long term. If things are left in limbo with no deal reached, this may result in the group keeping output unchanged in August and the rest of 2021. Such a scenario could see higher oil prices.

However, if the infighting means no OPEC+ deal by April 2022, this could result in a “free-for-all”, as major oil producing nations pump at will. If this is anything like what we witnessed in the 2020 price war with Saudi Arabia and Russia, oil prices would experience a steep selloff.

Dollar under pressure

King Dollar stumbled into Tuesday’s session under pressure, weakening against every G10 currency. Friday’s mixed US jobs report triggered some profit taking around the greenback with the DXY hovering above the 92.00 level.

Although the US economy created 850,000 jobs in June which was above market expectations, the unemployment rate edged up to 5.9%. These diverging labour market gauges are key elements in the Fed’s assessment and point to a Federal Reserve standing on the sidelines and not under pressure to change policy.

While the jobs data has eased rate hike worries, the recent jump in oil prices could revive these concerns. Higher energy costs may fuel inflationary pressures, strengthening the argument for the US Fed to tighten monetary policy down the road – something that could provide a tailwind to the dollar.

On the data front, investors will direct their attention towards the ISM Non-Manufacturing PMI for June which is due later in the day. All eyes will also be on the latest FOMC minutes on Wednesday which could provide clues about the central bank’s hawkish shift at its June meeting.

Looking at the technical picture, the Dollar Index remains bullish on the daily charts despite the recent declines. A pullback could be on the cards with 92.00 and 91.70 acting as levels of interest before prices potentially rebound back above 92.50.

Gold edges up on weak dollar

Gold appreciated above $1800 Tuesday morning thanks to the weaker dollar. Easing concerns over the Fed raising interest rates sooner than expected have also helped gold bugs ahead of the meeting minutes on Wednesday.

Looking at the technical picture, the precious metal has the potential to test $1825 and $1842 if a daily close above $1800 is achieved. Alternatively, a move back below $1800 could result in a decline towards $1760.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius