By Han Tan, FXTM Market Analyst

The week started off fairly quietly in terms of price action as analysts and economists make sense of the monthly US jobs numbers while also focusing on this week’s main events.

European bourses opened up mixed on Tuesday amid low ranges, while Asian markets traded in the green and red, with Japan’s Q1 GDP being upwardly revised to -3.9% q/q from -5.1% q/q initially reported.

Dollar direction

The dollar had a small bid earlier in the day trading just above 90 on the DXY, but within this week’s range, so far with no clear move lower after the US nonfarm payrolls second monthly miss in a row.

It seems the jobs report was not strong enough to price in a change to Fed rhetoric which many of the dollar bulls were expecting, and not weak enough for markets to turn lower.

Some market watchers are asking if we have hit the goldilocks scenario with the economy neither too hot nor too cold, but just about right. For the greenback, the fall in yields brings little support, though Monday’s follow-through selling has not been totally convincing.

Sterling uncertain

The UK economy is due to fully reopen on June 21, but there are now doubts about whether this will happen, as speculation is growing that this date may be put back two weeks.

Although major parts of the economy are up and running already, the psychological impact of a delayed move, plus the possible uncertain date of the “new reopening” is giving GBP bulls cause for thought.

Although major parts of the economy are up and running already, the psychological impact of a delayed move, plus the possible uncertain date of the “new reopening” is giving GBP bulls cause for thought.

The UK government is set to announce its decision next Monday, 14 June, so GBP may be choppy into this date.

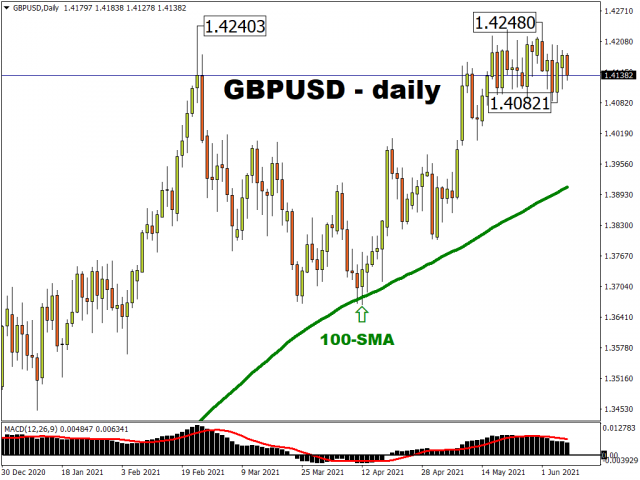

Cable is stuck in a 1.41-1.42 range with the 1.42 test last week being strongly sold into. The more we trade sideways and compress within narrow bands, the stronger the resultant breakout will be when it comes.

Resistance sits at the high from last Monday at around 1.4250, while a strong close below last week’s low at 1.4082 needed to encourage the sellers to come out in force.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius