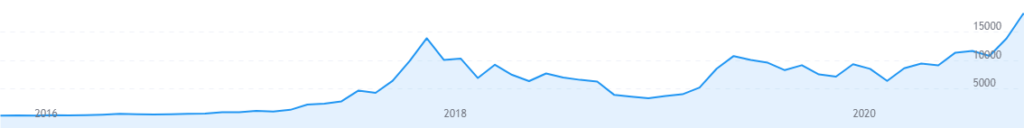

As Bitcoin nears all-time highs trading at $18,200 on Wednesday morning, a new poll shows that nearly three-quarters of high net worth individuals will be invested in cryptocurrencies before the end of 2022.

The survey, carried out by independent financial advisory deVere Group, found that 73% of respondents are now already invested in or will make investments in digital currencies, such as Bitcoin, Ethereum and XRP, before the end of 2022.

The findings come as the price of Bitcoin rallied to $18,230 in early Wednesday trading – approaching the $19,763 all-time high reached in December 2017.

The surge takes the leading cryptocurrency’s total market capitalisation to over $315 bln, just shy of its $335 bln record.

The 700-plus respondents to the deVere survey are clients who currently reside in North America, the UK, Asia, Africa, the Middle East, East Asia, Australasia and Latin America.

‘High net worth’ is classified as having a more than £1 mln (or equivalent) in investable assets.

“The price of Bitcoin is up 125% year-to-date, making it once again one of the best-performing assets of the year,” said deVere Group CEO and founder, Nigel Green.

“As the survey shows, this impressive performance is drawing the attention of wealthy investors who increasingly understand that digital currencies are the future of money and they don’t want to be left in the past.”

“As the survey shows, this impressive performance is drawing the attention of wealthy investors who increasingly understand that digital currencies are the future of money and they don’t want to be left in the past.”

The same poll undertaken last year found that 68% of high net worth individuals are now already invested in or will make investments in digital currencies before the end of 2022, meaning there has been a jump of 5% year-on-year.

Green, who launched the deVere Crypto app in 2018, added, “no doubt, many of these HNWs have seen that a major driver of the price surge is the growing interest being expressed by institutional investors who are capitalising on the high returns that the digital asset class is currently offering.

“They – together with some of the biggest Wall Street banks – are now aware that the world’s biggest and most influential decentralised currency isn’t going anywhere.

“This will mean that they are set to bring even more of their knowledge and capital into the already booming sector – and this is unlikely to have been overlooked by wealthy retail investors.”

“Nor too will the recent decision by one of the biggest payment companies in the world, PayPal, to allow customers to buy, sell and hold Bitcoin, have gone unnoticed,” Green explained.

In addition, the deVere CEO said that investors are being attracted to bullish Bitcoin as it is a “legitimate hedge against longer-term inflation concerns which have come to the fore due to stimulus packages”, more of which are promised by major governments and central banks around the world.

“These emergency measures, like the massive money-printing agenda, reduce the value of traditional currencies like the dollar.”

Other inherent characteristics of cryptocurrencies are piquing interest too.

Green said these include that they’re borderless, making them perfectly suited to an ever globalised world of commerce, trade, and people; that they are digital, making them perfectly suited for the increasing digitalisation of our world; and that demographics are on the side of cryptocurrencies as younger people are more likely to embrace them than older generations.

“High net worth individuals are not prepared to miss out on the future of money and are rebalancing their portfolios towards these digital assets,” the deVere CEO concluded.