By Han Tan, Market Analyst at FXTM

Asian stocks were in a sea of red on Friday while US equity futures extended their declines for the week as markets continued taking stock of the potent mix of major downside risks, from Covid-19’s resurgence in major economies to the looming US political uncertainty.

While Americans have been casting their votes early in droves, with an estimated 81 mln votes already made either in-person or via mail-in ballots, equity investors appear to have left it late in laying things on the line – four days before polling day.

Without the veneer of an imminent fiscal stimulus package for the US economy, risk assets finally had to face up to the threat of a double-dip worldwide recession and a contested US election outcome.

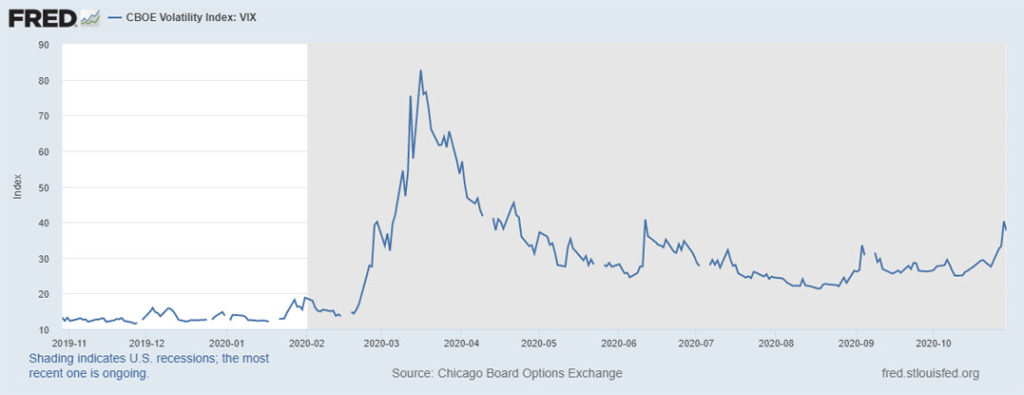

For the past six weeks, the VIX had been content staying below its pandemic-era average of 30. Now, stock investors have had any remaining sense of complacency wringed out of them by the markets this week, with the VIX spiking above the psychologically-important 40 mark, before moderating amid Thursday’s rebound. Still, with US stock futures pointing to further losses on Friday, the VIX was headed to end the week above this level, mirroring Friday’s volatility from earlier this week.

The S&P 500 headed towards its second consecutive weekly decline, and is just shy from matching the 4.78% drop registered for the trading week ending 12 June. And with this benchmark US equity index set to break below its 100-day simple moving average, such a technical event could herald further declines in the sessions leading up to the next week’s vote, and even after.

The S&P 500 headed towards its second consecutive weekly decline, and is just shy from matching the 4.78% drop registered for the trading week ending 12 June. And with this benchmark US equity index set to break below its 100-day simple moving average, such a technical event could herald further declines in the sessions leading up to the next week’s vote, and even after.

Given the very real chance of a delayed outcome to the 2020 US presidential elections, investors may opt to continue paring down their exposure to risk until there’s more clarity as to who will occupy the White House for the next four years.

Over the coming days, developments pertaining to US voting trends could have an outsized influence over broader market sentiment. Should risk aversion rule the roost, King Dollar could then comfortably reclaim its throne, having regained its status as the preferred safe haven asset.

Even tech stocks, which had assumed the safe-haven mantle amid the Covid-19 storm, have been found wanting of late. Big Tech now isn’t immune to this latest rout, judging by Thursday’s after-market moves, despite releasing some better than expected quarterly earnings.

Without these Tech juggernauts, which have been the main driver in US benchmark indices’ tremendous gains since the pandemic broke out, equity bulls have little else to push higher over the immediate future.

With market participants becoming increasingly hard to satisfy, traditional safe havens might be tempted to make hay over the immediate term until the market narrative shifts positively away from the pandemic and the US elections. Perhaps headlines pertaining to fresh waves of fiscal and monetary stimulus across Europe and the US could do the trick.

In the meantime, hold on to your hats, this roller coaster ride isn’t quite over.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius