By Han Tan, Market Analyst at FXTM

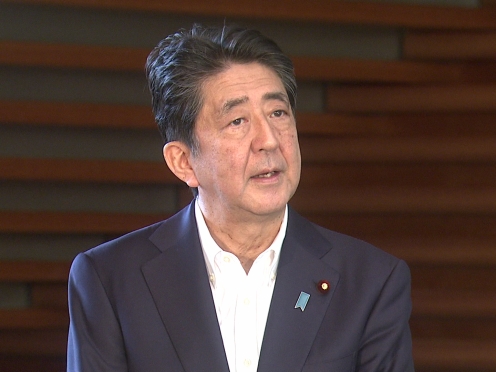

The Nikkei 225 ended the week 1.4% lower and the Japanese Yen broke to the stronger side of the 106 psychological level against the US Dollar, as Prime Minister Shinzo Abe announced his resignation Friday due to health concerns. Just this week, the 65-year-old Abe had marked his legacy as Japan’s longest-serving leader, and will continue on until a successor is chosen.

Investors will be eyeing this development through the lens of policy continuity, with questions framed around Abenomics in particular. This leadership transition arrives as the Japanese economy is still dealing with the negative impact from the pandemic. Longer-term concerns may also arise over how Japan can navigate ties with major economies such as the US and China in a post-Abe era.

Such a doubt-mired outlook lends itself to this knee-jerk sell-off mode in Japanese assets, with USDJPY set to face more volatility in the short-term. However, any instability and volatility that may arise from a leadership transition are expected to be transitory once investors have a firmer grasp on Japan’s policy outlook.

Fed flips the inflation script

Meanwhile, US equity futures edged higher and appear set to build on recent record highs, after Federal Reserve chair Jerome Powell essentially heralded a low-interest rate era for the US economy.

During a speech that was delivered virtually at the Jackson Hole Symposium on Thursday, Powell marked a new approach to how the central bank handles monetary policy by announcing that the Fed will aim for an inflation rate that averages 2% over time and allow for periods of overshoot.

The shift in the Fed’s policy framework augurs well for equities. Despite the recent rise in nominal 10-year Treasury yields, real yields continue to languish near minus one percent which ensures that the allure of stocks remains intact.

With the central bank also homing in on lower-income workers, that should also boost the prospects of American businesses, with investors expecting a steady supply of Fed stimulus.

Gold climbs after topsy-turvy ride

However, the jump in yields has been enough to cap Gold’s attempts to climb higher for the time being.

Gold prices were sent on a roller-coaster ride on Thursday night as investors tried to decipher what the Fed’s shifting stance on inflation could mean for the yellow metal, with prices soaring above $1970 before careening below $1910 in the immediate aftermath.

Gold’s wings were also clipped by the Dollar index which refused to capitulate. Bullion is currently trading around $1950.

If US yields march meaningfully higher over the near-term, that might deal a major blow to Bullion bulls’ expectations that the precious metal could push above the $2075.47 record high that was registered earlier this month, given that Gold is a non-yielding asset.

However, markets remain skeptical over when inflation will actually rise above 2% to begin testing the Fed’s newfound tolerance, and such doubts should put a lid on nominal yields while preserving the precious metal’s shine. And if the eventual idea is for the Fed to allow US inflation to move past 2%, assuming price pressures actually get there, that should also bode well for Gold given its traditional role as a hedge against inflation.

As long as real yields remain negative, coupled with dogged concerns over the global economic recovery as well as the risk of spikes in geopolitical tensions, the precious metal should have enough reasons to advance from current levels. With Gold being supported above its 50-day moving average, the fundamental factors that make for a conducive environment for the precious metal should remain intact for a while longer.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius