By Han Tan, Market Analyst at FXTM

The Dollar index (DXY) has broken below the 97 psychological level for the first time since March and is set to wrap up three consecutive weeks of declines. Having returned to pre-pandemic levels, the Dollar’s tumble is an overt sign of the risk-on stance in the markets.

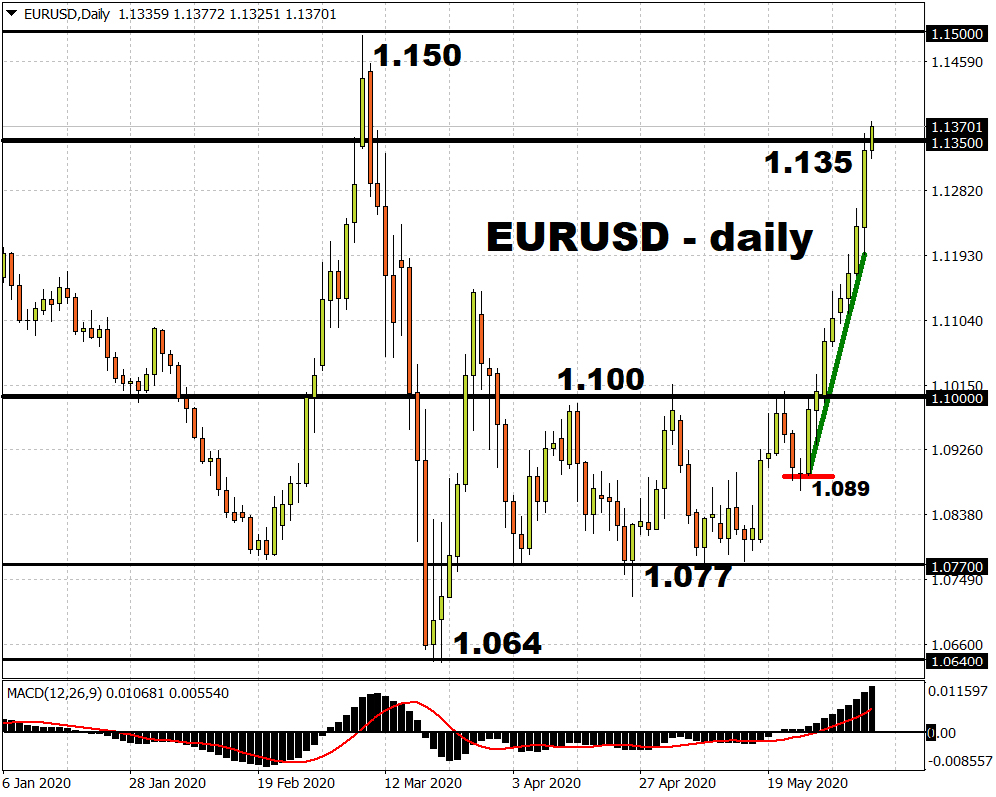

The Euro’s climb is having a major influence on the DXY decline, with the former accounting for 57.6% of the index’s total weighting. EURUSD’s breaching of the 1.1350 mark as the European Central Bank added €600 bln to its emergency bond-buying stimulus package at its meeting on Thursday, is exerting further downward pressure on the DXY.

The US Dollar’s decline also comes ahead of the May non-farm payrolls (NFP) due later Friday. Markets are forecasting a contraction of 7.5 million jobs last month, after the historic loss of over 20 million in the prior report, while the unemployment rate is expected to breach 19%.

Despite the carnage evident in the US jobs market left in the wake of Covid-19, investors have grown accustomed to this narrative since US weekly jobless claims begin soaring in the second half of March. Hence, financial markets are likely to look past Friday’s jobs numbers, barring any massive surprise, especially as the May 12 cut-off for the report points to the data not considering any re-opening measures in the second half of the month.

From a technical perspective, the DXY looks poised for a significant rebound, with the 14-day relative strength index (RSI) having broken into oversold territory.

Previous forays below the 30 line on the RSI, most recently in December and March, subsequently led to rallies in the Greenback. However, the downward momentum was not as forceful during those two previous episodes, so it remains to be seen how much the Dollar can pare its losses amid the present risk-on environment. At least Dollar bulls can take heart from the fact that since 2019, the DXY’s ventures below its 200-day moving average have not lasted long.

Should the US dollar continue faltering, the 96 support level could be called into action once more, as was the case on the final trading day of 2019.

While investors unpick the risk premiums accumulated at the height of the pandemic with the Greenback set to unwind more of its gains from recent months, we are unlikely to see a capitulation in the face of the global recession expected for the year.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius