By Lukman Otunuga, Senior Research Analyst at FXTM

Caution and unease are set to engulf financial markets ahead of one of the most uncertain earnings seasons for years, as it is expected to offer a bitter appetiser of the painful blow the coronavirus outbreak has dealt to US corporations.

Nevertheless, investors remain somewhat hopeful that the pandemic may be peaking, and this sentiment was reflected across Asian markets on Tuesday morning. The flicker of optimism from Asia could lend support to European shares before earnings kick off later in the day with JPMorgan Chase, Wells Fargo and Johnson & Johnson reporting their numbers.

Over the past few weeks, the negative impact of the coronavirus on the global economy has fueled speculation around first-quarter earnings disappointing forecasts. If expectations become reality, risk aversion will most likely make an unwelcome return, ultimately exposing stocks to downside shocks.

Is the Dollar’s crown under threat?

The Dollar weakened against a basket of major currencies on Tuesday as investors braced for a challenging earnings season.

Buying sentiment towards the Greenback will be tested this quarter as investors evaluate corporate earnings and economic data from the United States, which has been hit hard by the virus. Where the Greenback closes this week will most likely be influenced not only by earnings, but also the latest retail sales and unemployment claims data.

If the coronavirus outbreak has left prolonged cracks in the largest economy in the world, the Dollar’s throne could be under threat with market players seeking safety in the Japanese Yen or Swiss Franc. With regard to the technical picture, the Dollar Index is under pressure on the daily charts with prices heading towards 99.00. A break below this level may open the doors towards 98.90 and 98.30.

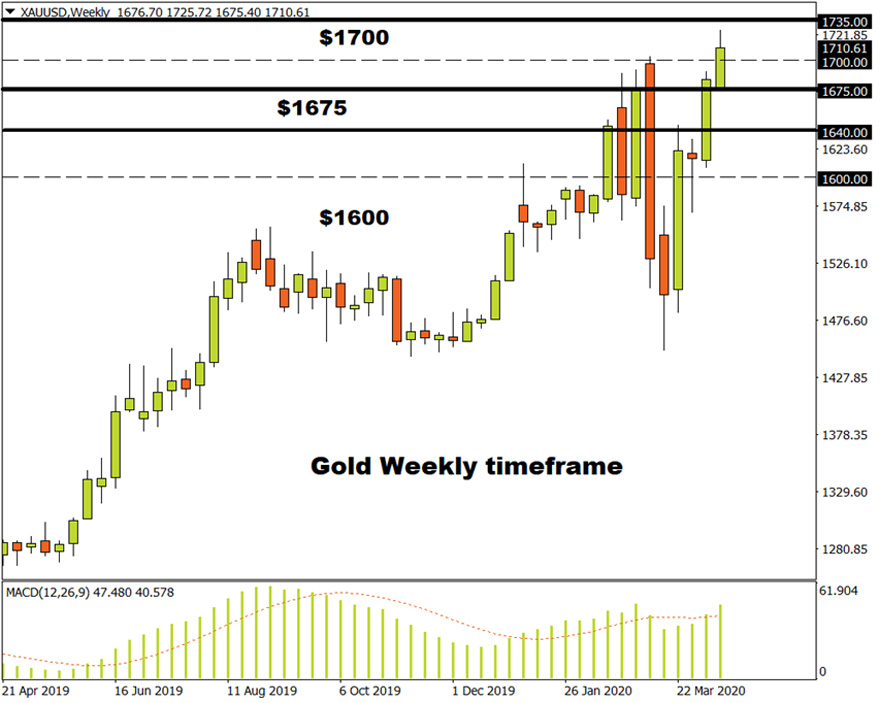

Gold hits 7-year high on recession fears

Gold has scaled levels above $1724 not seen in more than seven years, thanks to Dollar weakness and global recession fears.

The precious metal remains in fashion, appreciating almost 13% since the start of 2020. Further gains may be on the cards this week if corporate earnings paint a gloomy picture and the Dollar weakens on disappointing data. Looking at the technical picture, prices could jump higher towards $1730 if a solid weekly close above $1700 is achieved. Alternatively, sustained weakness below may open the doors back towards $1675.

For information, disclaimer and risk warning note visit FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius