By Naeem Aslam

European and US futures started the first trading day of December on a soft note as traders focus on two key factors.

First, the stellar rally in equity markets throughout 2024, coupled with the strong performance most stock indices posted in November. Second, how markets will respond to the upcoming wave of economic data and the trajectory set by central banks regarding monetary policy, particularly in light of recent inflation increases.

Asian markets saw decent price momentum, driven by better-than-expected Chinese Caixin Manufacturing PMI data. This signalled expanding manufacturing activity despite lingering concerns about potential tariff wars as 2025 approaches.

For now, investors are optimistic about the positive effects of the People’s Bank of China’s measures and government stimulus efforts, which appear to have revived economic momentum.

Europe Braces for Manufacturing PMI Data

On the economic docket, this week promises to be eventful, with traders and investors closely monitoring Manufacturing PMI numbers on Monday.

Concerns about the economic health of major Eurozone players, particularly Germany and France, are growing. France, often referred to as the “sick man of Europe,” is underperforming significantly, with its economic conditions now seen as more dire than Greece.

The spread between German and French risk-off assets highlights that traders view Germany as a safer bet.

However, German manufacturing data in 2024 has also been disappointing, with PMI readings consistently below the expansionary threshold of 50 and occasionally flirting with the low 40s. This underscores Germany’s struggle to shoulder the weight of weaker economies within the Eurozone.

US ISM Manufacturing Data and Fed

In the US, the focus is on ISM Manufacturing PMI numbers and speeches from FOMC members Waller and Williams. Their remarks could add to the prevailing uncertainty following the recent FOMC minutes, which provided no clear signal about the Fed’s next steps

While many market participants hope for another rate cut before the year-end, the odds of such an action have diminished following recent economic data.

XRP Leads Crypto Rally

Cryptocurrencies stole the spotlight over the weekend, with XRP surging to reclaim its position as the third-largest crypto by market capitalisation.

Traders believe XRP was undervalued, especially after resolving key issues with the SEC, setting the stage for a price recovery. Many XRP holders are targeting $5 as a realistic price level.

However, concerns linger over Bitcoin’s ongoing consolidation, which could lead to further downside before any potential rebound.

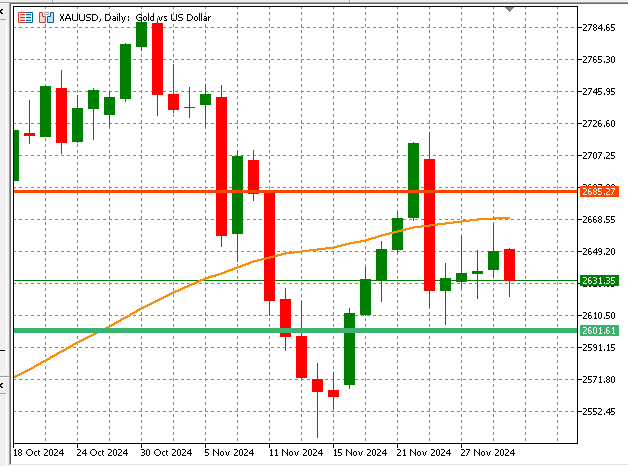

Gold Faces Headwinds

Gold is likely to remain in focus this week after a modest recovery last week.

However, the strength of the US dollar and the slim odds of a Fed rate cut may create headwinds for the yellow metal. Additionally, escalating geopolitical tensions, particularly in Syria, could lend support to XAUUSD as investors seek safe-haven assets.

Gold chart by Exness

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.