By Naeem Aslam

European and US markets traded a bit mixed Tuesday due to conflicted emotions following the Federal Reserve Chairman’s failure to meet market expectations on Monday night.

But smart money knows well that Fed Chair Jerome Powell wasn’t going to come out of the gate and say it loudly that the next rate cut is going to be another 50 basis points and show how desperate the Fed is.

In fact, the Chairman’s approach was more than enough to understand the matter if one pays close attention to details. He stated that there will be more rate cuts, and the extent of these cuts will depend on the economic data.

The economic data has revealed that the Fed is making every effort to prevent a hard landing. To achieve this, they will need to reduce interest rates more aggressively.

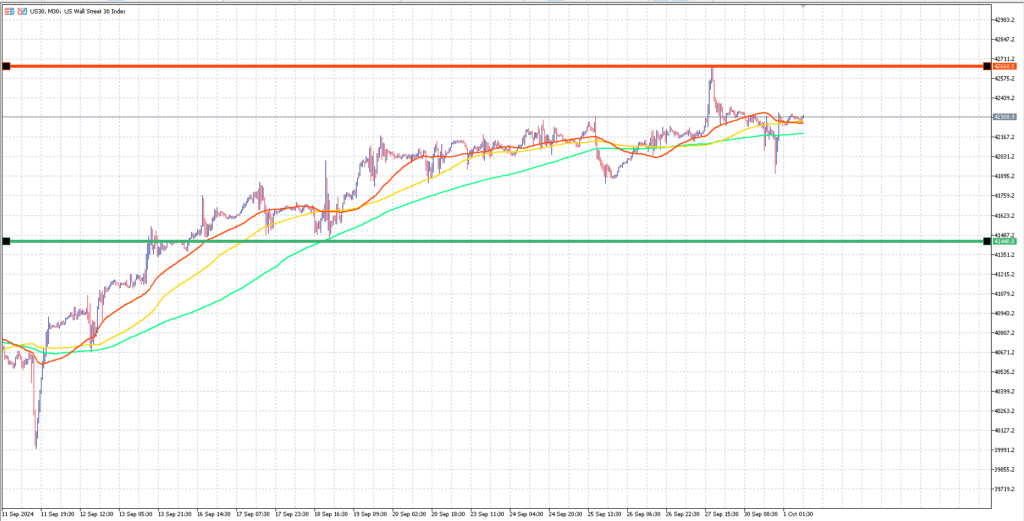

The US 30 Chart by XTB

Economic docket

As mentioned in our notes on Monday, the data on the economic docket this week will be crucial for traders and investors.

The NFP, due on Friday, is the monster number and commands the most importance, but the economic numbers leading to that day are also important, and they would most certainly bring enormous volatility to the US stock market.

First, traders should pay close attention to the Eurozone Core CPI flash estimate y/y and Eurozone flash CPI. The Eurozone CPI estimates will also be released, and any further downward move in these numbers would encourage currency traders to bet for another rate cut from the ECB.

In the US, we have ISM manufacturing, JOLTS job openings and ISM manufacturing prices data.

All these economic prints are highly important for traders, as the Fed has now made it clear that their interest rates are very much data-dependent.

It is going to be very much a scenario where bad news becomes good news, as traders would anticipate a deeper interest rate cut from the Fed if the economic data begins to show weakness.

Asian Markets

In Asia, while market volume remains somewhat subdued due to the Chinese holiday, traders continue to pay close attention to the measures taken by the PBOC and the fresh economic data from other important economies, such as Japan.

Tuesday’s Tankan Manufacturing index and non-manufacturing numbers have both produced readings that have been better than expectated, and this alone has lifted spirits among traders.

Traders want to see improvement in the economic numbers, especially when it comes to Japan and China, and when they do actually witness these numbers, their spirits are lifted and they have more appetite for riskier assets.

Aussie Markets

As for Australia, we have had a bag of mixed news.

Firstly, there is plenty of pressure on the central bank to cut interest rates, and the bank itself has been pushing against all that pressure because it wants to see a bit more evidence.

However, traders understand that the RBA’s failure to take necessary action will result in significant costs. This is evident in the economic numbers, such as the Building Approvals number, which plummeted by -6.1%. However, the retail sales number showed some improvement with a reading of 0.7%.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.