By Naeem Aslam

Investors and traders are very much on the edge as the biggest event of the year will unfold, as the Federal Reserve will announce its monetary policy rate decision.

Traders have been looking for a dovish narrative from the Fed for a while now as the economic data continues to support the narrative that the US economy is heading towards a soft landing.

Having said that, there are still significant threats out there for the US economy, as the recent inflation readings have taken a wrong turn, and this is keeping pressure on the Fed.

Throughout this month and this week in particular, traders have started to beat the drums louder for the Fed to cut interest rates. However, the Fed is under no pressure to cut the rate during this meeting, as it was still talking about financial conditions becoming tighter, and in the December meeting, the Fed started to talk about some possibilities of adopting a cut in the interest rate.

Traders and investors widely know that the Fed will cut interest rates this year, but the big question is when the process will begin and what will be the key driver to begin the process.

Slim chance

Market players aren’t expecting an interest rate cut on Wednesday, as the probabilities of that taking place are less than 5%. So, if one likes to bet on the Fed to cut interest rates now, the odds aren’t strongly stacked in your favour.

What traders would like to see in this meeting is that the Fed has started to talk about cutting interest rates.

The narrative is expected to be much more neutral to somewhat dovish, which means that the Fed will balance both sides of the argument.

If we look at the Fed fund rate and the odds of the Fed interest rate coming lower, those odds show that there is a 35% chance that the Fed will begin the process of cutting the interest rate in March.

What will speed up Fed cut?

The Fed is still very much focused on the price stability element, without any doubt; the most important factor is to keep things in check.

The labour market isn’t showing signs of weakness. Although the fresh US ADP number has shown somewhat weak readings, nothing is out of the ordinary there, which would make the Fed worry about a drama in the labour market.

The US earnings, which are out so far, continue to paint a more optimistic picture. But threats to inflation are still strong.

As geopolitical tensions are very much anchored in place and shipping costs have increased dramatically due to higher geopolitical tensions around the Red Sea passage through the Suez Canal, things are likely to add more headwinds for inflation numbers to come lower.

Market reactions

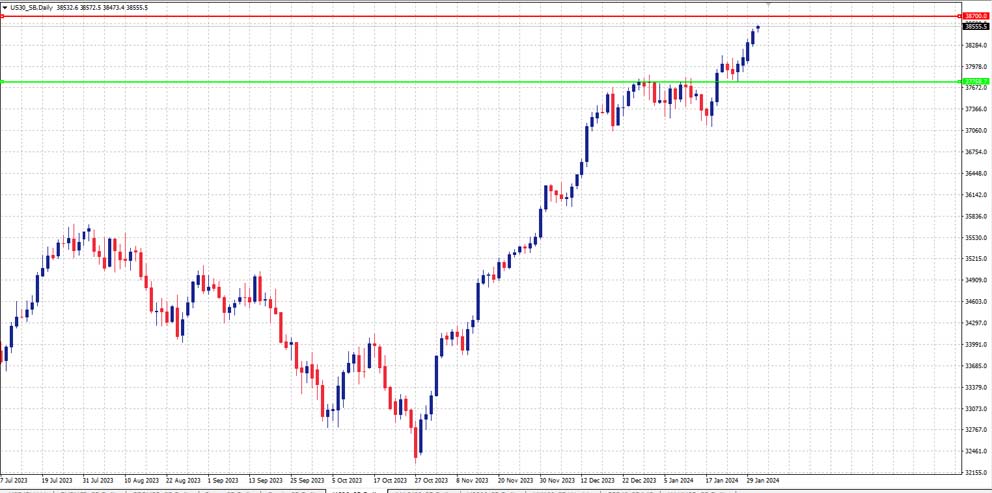

In terms of the US30 (Dow Jones 30), the current market trend continues to remain highly strong.

If the Fed shows its dovish side on Wednesday, we are likely to get more optimistic moves in the S&P 500, which means we could see higher highs. However, if the Fed continues to hold a more neutral stance, we could see some more steam coming out of the current rally.

The important levels are shown in the chart below.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.