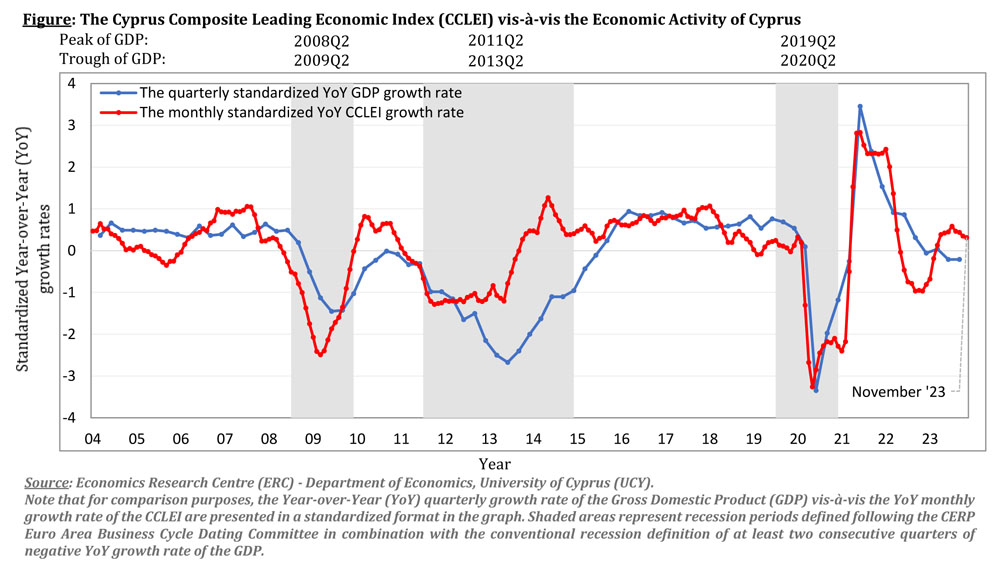

The growth prospects of the Cyprus economy seem to be struggling, impacted by ongoing regional geopolitical tensions, which is keeping the annual growth rate at a subdued pace, according to leading indicators that provide warning signals for future economic activity.

The year-over-year growth rate of the Cyprus Composite Leading Economic Index (CCLEI) remains positive, but continued its slowdown in November, according to the University of Cyprus Economics Research Centre (ERC) that compiles the indicator.

The ERC report said that, “the continued deceleration of the CCLEI reflects the burdened geopolitical and unstable economic environment, which inevitably negatively affects the growth prospects of the Cypriot economy.”

The CCLEI recorded a year-over-year increase of 1.8% in November, following the year-over-year increases of 1.9% and 2.4% recorded in October and September, respectively (based on recent and revised data).

A year ago, the CCLEI recorded an annual decrease of 2.6% in October, amid continued uncertainty over the Russia-Ukraine war, as the highly volatile geopolitical environment continues to cast its shadow.

The military conflicts in Israel since October this year have further burdened the already negative international geopolitical environment, inevitably affecting the November CCLEI.

Economic sentiment

In particular, the increased geopolitical tensions continue to negatively affect the economic sentiment indicator (ESI) in the Euro area, with the year-over-year growth rate of the Euro area ESI remaining negative from April 2022.

In contrast, the positive year-over-year growth rate of the CCLEI in November is attributed to the growth of various domestic sectors, including real estate, tourism, retail trade, and electricity production. Furthermore, the drop in the CCLEI is restrained by the international price of oil, which fell significantly in November.

In summary, the year-over-year growth rate of the CCLEI remains positive, albeit continued decelerating in November.

The components of the CCLEI have been selected from a large pool of domestic and international leading indicators.

The CCLEI for November, based on the econometric model of Aruoba, Diebold, and Scotti (2009), is estimated on the availability of the Brent crude oil price (in euros), the economic sentiment indicators (ESIs) in the Euro area and in Cyprus.

Other contributing factors include the total number of property sales contracts, tourist arrivals, the value of credit card transactions, as well as the high-frequency data of the temperature-adjusted volume of electricity production.