DBRS Morningstar Analysis

The New Democracy Party (ND), led by Prime Minister Kyriakos Mitsotakis, won 146 out of 300 seats in Greece’s general election on Sunday. This is five seats short of an overall majority.

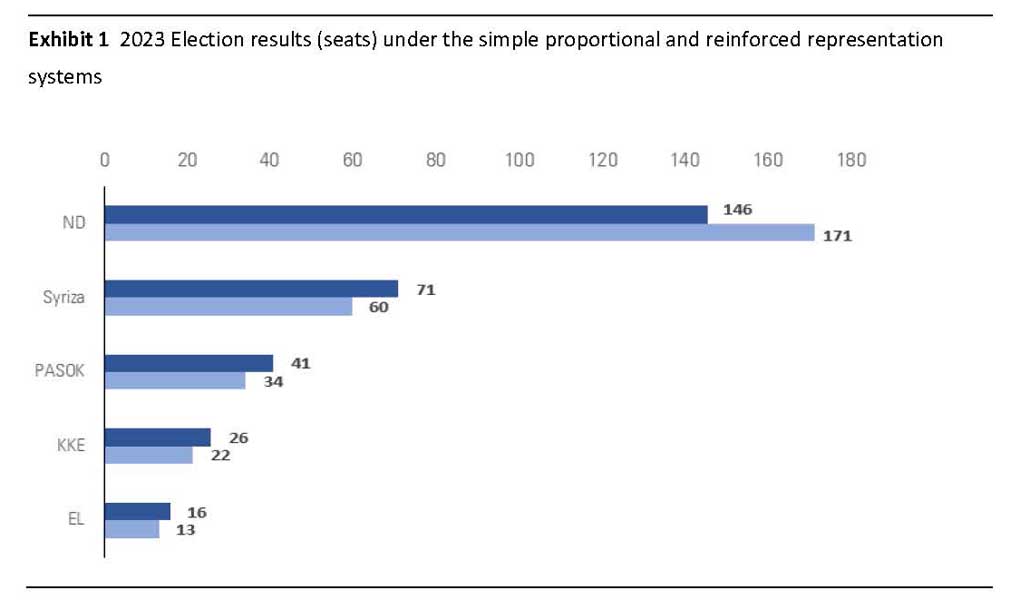

New Democracy won 40.8% (146 seats), Syriza 20.1% (71 seats), PASOK 11.5% (41 seats), the Communist Party of Greece (KKE) 7.2% (26 seats) and the Greek Solution (EL) 4.5% (16 seats). ND is now seeking another election that this time will use a form of bonus system, that could enable ND to win an overall majority.

PM Mitsotakis has returned the mandate to form a government, and the leaders of the second and third largest parties are expected to do the same. At the moment, June 25 seems the most likely date for the second election.

Elections and Law Changes

The election was held under a new simple proportional representation system.

Despite the fact that the electoral law was voted in 2016 by the SYRIZA/ANEL government, it became valid for use only after the previous 2019 election. In January 2020, the ND government passed another new electoral law reintroducing a reinforced representation system that brings back an element of bonus points.

As the law fell short of the 200 votes needed for the change to take immediate effect, this electoral system is only now eligible for use.

As the law fell short of the 200 votes needed for the change to take immediate effect, this electoral system is only now eligible for use.

It resembles the reinforced representation system that was in place since the early 1990s, albeit calculated based on a different formula. It secures up to 50 bonus seats for the winning party.

Likely Political and Economic Outcomes

If New Democracy manages to keep its share of votes, combined with the same high share of parties not reaching the 3% threshold, the outcome of a second election could result in a strong outright majority for ND. This will bring another period of political stability to Greece.

ND’s potential win would give it a mandate to continue with the implementation of reforms and investments, increasing Greece’s growth prospects. Improved growth prospects from the expected €30.5 bln Recovery and Resilience Fund (RRF) expenditures for reforms and investments, is a contributing factor to potential credit improvements in DBRS Morningstar’s rating for the Hellenic Republic of BB (high) with a Stable trend.

In recent years, Greece has experienced a prolonged period of political and economic policy stability, despite the challenges of the pandemic and subsequent energy crisis. Greece’s past reforms and support from European institutions during the pandemic, backed a strong economic rebound in 2021 and 2022.

Real GDP is expected to come in at 2.4% this year according to the European Commission, underpinned by domestic demand, mainly by strong investment activity.

The implementation of the RRF is expected to continue providing incentives for reforms and investments.

In 2022, Greece recorded a small primary surplus and according to the government’s Stability Programme 2023, the budget position will further improve this year, while government debt is projected to fall to 163% of GDP.

We take the view that Greece will maintain its fiscal discipline, nevertheless, downside risks remain related to economic legacies such as the very high public debt ratio and high share of non-performing loans in the banking system compared with its euro area peers.