By Jeffrey Halley

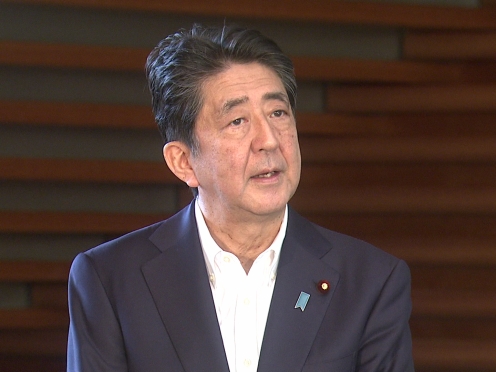

Japan’s former Prime Minister Shinzo Abe is in “grave condition” after being shot while campaigning for parliamentary elections in the city of Nara.

Current PM Fumio Kishida said Abe is in “very grave condition”, adding that “this attack is an act of brutality that happened during the elections – the very foundation of our democracy – and is absolutely unforgivable.”

As we wait for more details to unfold, there have been some noticeable impacts on Japanese markets.

The Nikkei 225 has unwound all its early rally, falling to unchanged. Meanwhile, some Yen haven buying is going through forex markets, pushing USD/JPY down 0.40% to 135.40. Still, it’s only money, and my thoughts are with Mr Abe and his family at this time.

Elsewhere, we saw recession fears ebb on Wall Street overnight once again, with stock markets racing to price in a lower terminal Fed Funds rate because of slower growth, or as I call it, any desperate reason to buy the dip.

It came despite a sharp rally in oil markets, where there is a genuine reason to buy the dip, despite two Fed officials calling for a 0.75% rate hike this month, pushing US yields slightly higher.

Needless to say, today’s lower terminal Fed Funds buying excuse can just as quickly become tomorrow’s recession/inflation sell-everything move. Readers should resist the temptation to get caught up in the day-to-day noise, it’s an easy way to end up crossing spreads, and get whipsawed, and it is clear that the US equity market has no idea which way the tree will fall either.

One point of volatility Friday evening is the US Non-Farm Payroll data.

The Street is forecasting an additional of 268,000 jobs, down from last month’s blockbuster 390,000 print, but still pretty decent. Unemployment is expected to remain steady at 3.650%.

The back-month revisions may drive volatility more than the headline and trying to predict the market reaction ahead of time is usually a lose-lose situation.

Given the complacency around the path of Fed rate hikes this week, in the context of an apparently looming recession, my guess is that a high number will provoke a stock market sell-off. The logic is we were wrong about fewer Fed rate hikes, and better sell equities, especially the Nasdaq.

Conversely, a lower number which would point to a slowing economy likely means the gnomes of Wall Street will decide they were right about fewer rate hikes, so buy everything, especially the Nasdaq. Obviously, a recession isn’t a conducive environment for equities either, but why let the detail get in the way of the preferred story?

UK equities rose on PM Johnson’s resignation announcement on Thursday, but it seems more like a protest vote, and not a structural turn in sentiment.

Other news Friday morning is that China is considering allowing local governments to bring forward CNY 1.5 trillion ($220 billion) worth of bond issuance from their 2023 quotas, into H2 2022.

The bonds, which are mostly used to fund infrastructure, would give a healthy dose of stimulus to try and get the Chinese economy back on track to meet those ever-distant 2022 growth goals. In the short term, that should be a positive for China markets, although the price action on Mainland and Hong Kong equity markets is underwhelming.

If true, I would say that it isn’t a sea-change approach from China, more an accounting smoke and mirrors. NPV-ing next year’s infrastructure spending into this year would be a nice short-term boost, but if they don’t also increase the 2023 bond issuance quotas as well, net-net, it’s a zero-sum game.

Asia stocks follow Wall Street higher

Wall Street shrugged off some hawkish rhetoric from the FOMC members’ rent-a-crowd overnight, myopically sticking to a recession equals lower rates equals buy stocks mantra.

With nothing else to shake that tree, I can’t blame them for their enthusiasm. The buy-the-dippers piled into the growth trade, despite oil and US yields rising.

The S&P 500 rallied by 1.50%, with the Nasdaq leaping by 2.28%, and the Dow Jones gaining 1.12%. In Asia, some profit-taking is occurring, pushing futures on all three indexes down by around 0.20%.

In Asia, the Abe shooting wiped out the early rally by the Nikkei 225, which is now unchanged on the day. South Korea’s Kospi has also given back some gains but remains 0.85% higher.

Mainland China has barely reacted to either Wall Street overnight, or the China bond issuance story. The Shanghai Composite and CSI 300 are up just 0.20%, while Hong Kong’s Hang Seng Index is just 0.40% higher.

Oil rallies sharply

Oil had another hugely volatile session overnight, with Brent crude and WTI rallying by over 4.0%, reversing the Wednesday losses.

That came despite a huge increase by US official Crude Inventories by 8.235 million barrels. That was a slightly misleading headline though, with the increase aided by disruptions in US refineries. Notably, gasoline inventories slumped by 2.5 million barrels as well. With US refining capacity running at an unrealistic 94.50%, any disruption will impact refined products and backstop WTI, in particular.

Brent finished 4.50% higher at $104.25 a barrel, while WTI rallied by 4.15% to $102.20. Oil’s rally started on Thursday as the $100.00 Brent crude proved an irresistible temptation for Asian physical buyers. The slump in US gasoline inventories helped the process along by highlighting how tight supplies remain, especially in the refined categories.

Asia continued buying the dip Friday as well, perhaps cognisant of weekend headline risk. Brent crude has risen 0.75% to $105.00, with WTI adding 0.50% to $102.80.

Brent has resistance at $106.00 and then its 2022 trendline breakout at $108.85, followed by the 100-day moving average (DMA) at 110.50. It has traced a double bottom at $98.60, followed by the 200- day moving average (DMA) at $96.35.

WTI has resistance right here at $102.00 and then it’s 100-DMA at $107.16 a barrel. Support is at $96.60, $95.00, and then its 200-DMA at $93.50.

Gold sideways in Singapore

Without much movement in the currency space overnight, gold remained almost unchanged at $1740.50 an ounce, trading in a narrow range. Asia is equally dull, gold edging lower to $1740.00 an ounce.

Since breaking $1780.00, gold’s technical picture has deteriorated rapidly, and it remains at the mercy of the US Dollar’s direction. The only positive note to be seen is that its RSI has fallen into oversold territory, allowing for a modest corrective rally to occur.

Despite a couple of sessions of sideways trading, gold remains anchored at the bottom of its range and only a miracle slump by the US Dollar Friday evening is likely to move it off the seafloor.

Gold has resistance at $1780.00, $1785.00, and $1820.00, its downward trendline. Support is at $1720.00, followed by $1675.00. Failure of longer-term support at $1675.00 sets in motion a much deeper correction, potentially reaching $1500.00.

Jeffrey Halley is Senior Market Analyst, Asia Pacific at OANDA

Opinions are the author’s, not necessarily that of OANDA Global Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Losses can exceed investments.