While the re-election of Emmanuel Macron reduces the inherent short-term uncertainty that would have been associated with a Le Pen presidency, and reinforces the likelihood of broad policy continuity, fiscal challenges remain elevated for the President and the future government, a market analysis suggests.

Maintaining a majority in the parliament following the legislative elections in June will remain key for President Macron to deliver on his policy and reform agenda, according to a DBRS-Morningstar commentary on Tuesday.

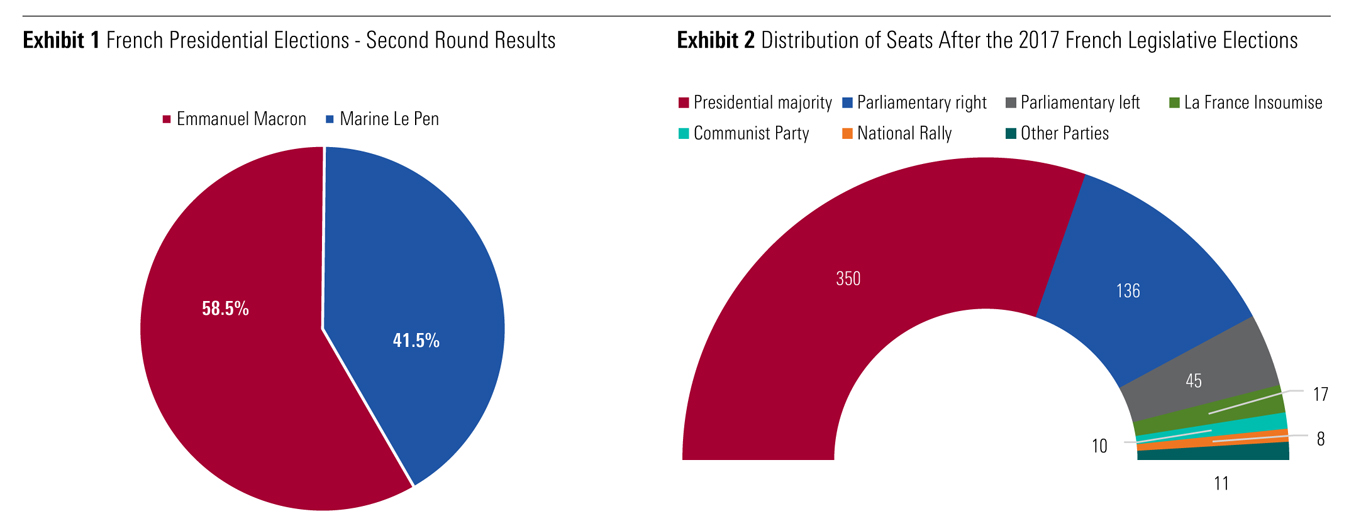

Macron won the election on April 24 with 58.5% of the votes, against contender Marine Le Pen (41.5%).

While it was tighter than in 2017 when Macron won with 66% of the votes (Le Pen: 34%), the margin of victory was wider than initially estimated by voting intentions.

The election has been affected by the lowest turnout for a second round of a presidential election since 1969 with an abstention at 28%.

DBRS Morningstar said in its special report that President Macron’s re-election reduces the short-term uncertainty that would have been associated with a Le Pen presidency especially given some of the Eurosceptic policies included in her programme.

While the likelihood of broad policy continuity has been further reinforced by the outcome of the presidential election, the rating agency said continues to consider that the parliamentary elections on June 12 and 19 will remain key for the President to implement his policy agenda going forward.

Fiscal challenges remain

In the very short-term, the French government is likely to resign, and President Macron will subsequently appoint a new government which will remain in place until the legislative elections in June.

Obtaining a similar majority to that obtained in 2017 – 350 seats out of 577 in the lower house or 61% after the second round – is likely to prove difficult, given the further polarisation of the French electorate over the last five years.

Nevertheless, gathering a sound working majority, possibly through a coalition with parties sharing similar policies, remains possible and will be key for President Macron to resume his reform efforts in coming months.

Given the additional budgetary spending announced during the presidential campaign, including the extension of support measures to mitigate the effects of inflation, the possible early indexation of pensions and an increase in teachers and other civil servants’ salaries, DBRS Morningstar said that rebalancing fiscal accounts “will remain quite challenging for the French government.”

“Nevertheless, rebuilding fiscal buffers after years of exceptional spending throughout the COVID-19 pandemic will be one of the primary tasks for the future French government,” in DBRS Morningstar’s view.

The rating agency said it continues to take the view that the future government will remain fully committed to improving the country’s medium-term fiscal trajectory.

As mentioned in the April 1 announcement confirming France’s AA (high) Long-Term ratings with a Stable trend on 1 April 2022, France’s ability to stabilise its debt-to-GDP ratio and then subsequently place it on a firm downward trend will remain key determinants of the country’s future credit profile, DBRS Morningstar concluded.