By Lukman Otunuga, Senior Research Analyst at FXTM

Words fail to describe the astonishing events over the past few days which have undoubtedly left a mark in the manuals of market trading history.

Investors were already juggling with a busy week jampacked with key events and economic data from major economies.

However, the extraordinary developments revolving around GameStop and the eye-popping movements in the company’s stock, fuelled by a Wall Street retail-trading mania, have been utterly surreal.

This mythical, but real tale of a heated battle between the Reddit Wall Street Bets and hedge funds has created shockwaves across markets and is likely to remain a popular talking point for years to come. Given the gravity of the situation, the next few days and even weeks could be wild for financial markets.

Speaking of markets, Asian shares fell on Friday amid worries about rising coronavirus cases and a liquidity squeeze in China. European shares opened lower as countries grapple with new variants of coronavirus amid extended lockdowns.

Safe-haven dollar steadies

The dollar steadied on Friday, heading for a weekly gain as the fierce battle between Reddit traders and Wall Street boosted demand for safe-haven assets.

Since the start of the week, the greenback has derived strength from concerns around a possible delay in Joe Biden’s $1.9 trillion fiscal package. The upside was also fuelled by hiccups in the coronavirus vaccine rollouts across the world.

Given how uncertainty is likely to intensify amid the developments in Wall Street, investors may rush towards the dollar’s safe embrace in the near to medium term.

Looking at the technical picture, the Dollar Index has gained just over 0.5% this week. It will be interesting to see whether bulls can achieve a weekly close above 91.00.

Same old Gold

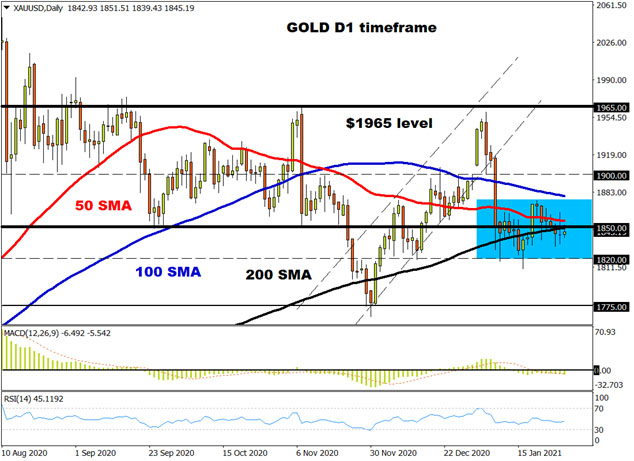

Over the past few weeks, it has felt like the same old story for gold.

Prices have oscillated around the sticky $1850 region due to the absence of a fresh directional catalyst. Bulls remain empowered by the great “reflation trade” and surging coronavirus cases, while bears continue to draw strength from a stabilising dollar.

Given how prices are trading marginally below the 200-day Simple Moving Average, the current outlook swings in favour of the bears. Sustained weakness below $1850 could open the door back towards $1800.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by the CySEC (licence no. 185/12) and licensed by the SA FSCA with FSP number 46614. Forextime UK Limited is authorised and regulated by the FCA (licence no. 777911). Exinity Limited is regulated by the Financial Services Commission of Mauritius with license number C113012295.