Stock markets have been cheered on hopes of fresh fiscal stimulus in the U.S. imminently – but investors must avoid the ‘buy everything’ mindset, warned Nigel Green, CEO of deVere Group, one of the leading financial advisory and fintech organisations.

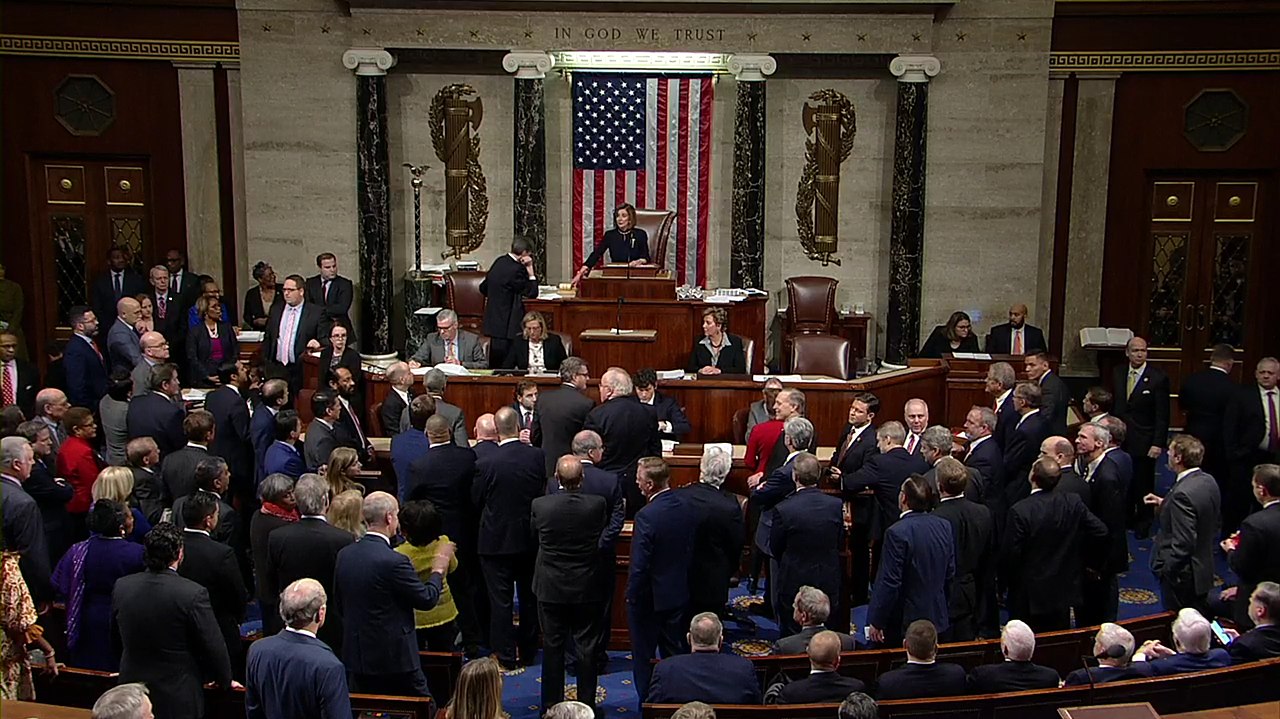

Over the weekend, House Democrat leader Nancy Pelosi said she was “optimistic” regarding a stimulus deal before the presidential election on November 3.

In Asia, Hong Kong’s Hang Seng gained 0.5% and Japan’s Nikkei climbed 1.1%, South Korea’s Kospi advanced 0.22%, Australia rose on the day, with the S&P/ASX 200 up 0.85%.

Meanwhile, London’s FTSE rose 0.6%, Germany’s Dax rose 0.9% and the Europe-wide Stoxx 600 climbed 0.8%.

U.S. futures also pointed higher.

“The possibility of a fresh fiscal stimulus shot in the U.S. – the world’s largest economy – is acting as a catalyst in driving global stocks higher,” said Green.

“Investors are moving now to buy stocks to bolster their portfolios ahead of the announcements in the coming days when prices will jump even higher – so they’re taking advantage of what they see as the current lower entry points.”

The deVere CEO added that once again, we’re seeing that few things can fuel markets like a stimulus injection – or even the possibility of one.

“Clearly, investors are not wanting to miss the boat, but they must also avoid the ‘buy everything’ mindset for two reasons,” said Green.

“First, the markets are now assuming that the new stimulus is a done deal – it is not. If negotiations collapse, the market correction could be significant.

“Second, not all shares are created equal and stock markets are heavily unbalanced at the moment. A handful of firms in a handful of sectors are bringing up entire indexes.

“An experienced fund manager will help investors seek those most likely to generate and build their wealth over the long-term.”

The deVere CEO concluded that investing over the long-term on stock markets remains, as ever, one of the best and proven ways to accumulate wealth.

“However, investors must remember not to be complacent when an upbeat mood takes over the markets.”