By Han Tan, Market Analyst at FXTM

All eyes will be on President Trump, who is set to announce new US policies towards China some time on Friday. And nervousness in markets is already showing.

Asian equities are mostly lower, taking some of the gloss off the MSCI Asia Pacific Index’s otherwise remarkable 24% advance since the March 23 low. US stock futures are also in the red, while Gold remains elevated above the psychological $1700 level.

Equities had been willing to look past the risk of escalating US-China tensions over recent weeks because the threats had largely been confined to mere sabre-rattling. Sometime on Friday, that Trump rheotric is set to evolve into actual policies, potentially in the form of sanctions, which could shatter the stability that the world sorely needs in these early days of the post-pandemic era.

It’s ironic that President Trump, who has often touted the rise in stock markets as a measure of his administration’s success, may now be the cause for its decline. Should his soon-to-be-unveiled policies prove to have more bite than bark, this could trigger more unwinding of the advances seen in equities over the last few weeks.

Dollar’s decline could be halted by Trump’s move against China

For now at least, Donald Trump is getting one of his wishes, a weaker US Dollar.

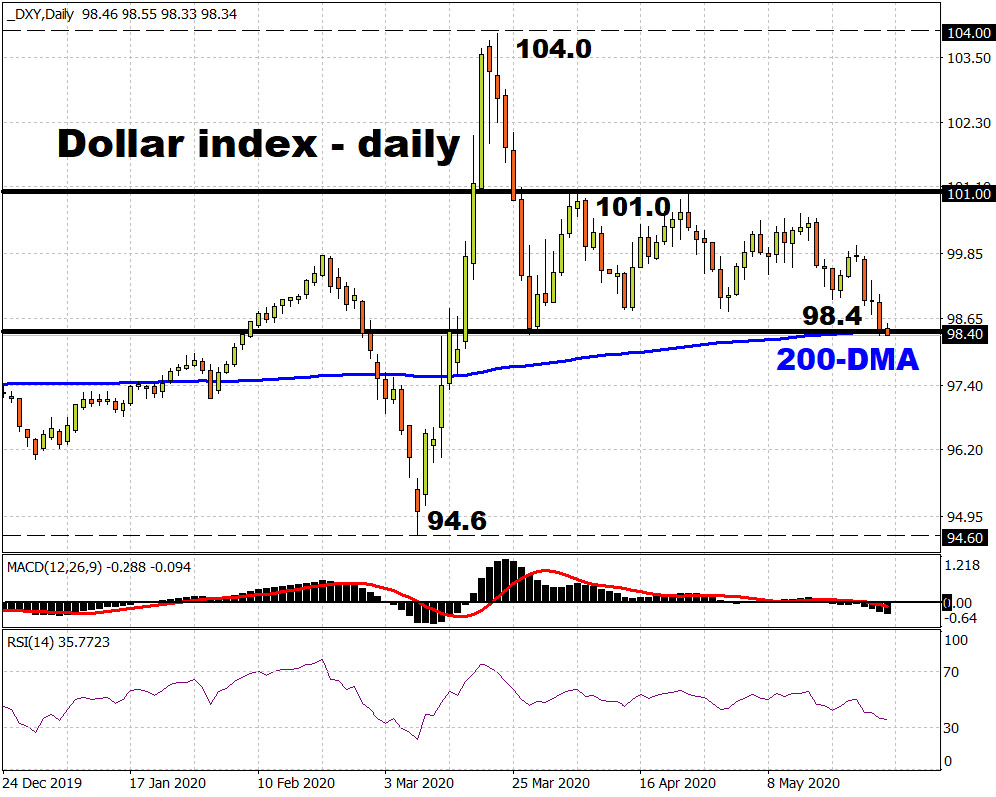

The Dollar index (DXY) is now testing its 200-day moving average and is trading around its weakest levels since March, as investors shift towards riskier assets amid optimism over the global economy’s reopening.

The latest US continuing claims report hints that the worst in the jobs market could be behind us, as more states allow businesses to reopen. Even though a full recovery in the US employment landscape could take years, such greenshoots of optimism appear enough to dampen demand for the Greenback.

The DXY has already broken down through the lower part of the 98.40-101 range that it’s been confined to over the past couple of months, after the Federal Reserve stepped in to quell Dollar-funding pressures during the heat of the pandemic crisis. With its 50-day moving average starting to turn south coupled with momentum technical indicators pointing down, a break below the psychologically-important 98 level could bring the 97.60 support level into play.

However, should risk-off sentiment grip global investors once more by way of a significant deterioration in US-China ties, that could jolt the Greenback back into its 98.40-101 range.

Bullion bulls await Trump’s unveil

Gold is finding no shortage of suitors amid these uncertain times, evidenced by the short-lived dip into sub-$1700 territory on Wednesday. Despite posting lower highs and lower lows since breaching $1760 on May 18, Bullion is still set to register two consecutive months of gains. Gold-backed ETFs have increased their holdings for six consecutive months, according to Bloomberg data.

Demand for safe haven assets could see a major boost going into the weekend should President Trump’s next steps against China puncture the optimism surrounding the world economic recovery. In such a scenario, Gold investors may be able to achieve what they couldn’t do in 2012, that is to see Bullion claim the $1800 handle.

For information, disclaimer and risk warning note visit: FXTM

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius