Bitcoin’s historic halving event on Monday, occurring every four year, showed that the “long-term future of cryptocurrencies is secure”, according to Nigel Green, CEO and founder of independent financial advisory deVere.

The highly anticipated halving event means that less and less bitcoin – which is limited to 21 million units – will now been mined.

Monday’s was the third ever halving: in 2012, the number of new bitcoins issued every ten minutes fell from 50 to 25; in 2016, it went down from 25 to 12.5; and, in the 2020 halving, it will drop from 12.5 to 6.25.

The halving happened on block 630,000.

“The historic bitcoin halving event has demonstrated in two ways that digital assets’ long-term future is secure,” said deVere’s Green.

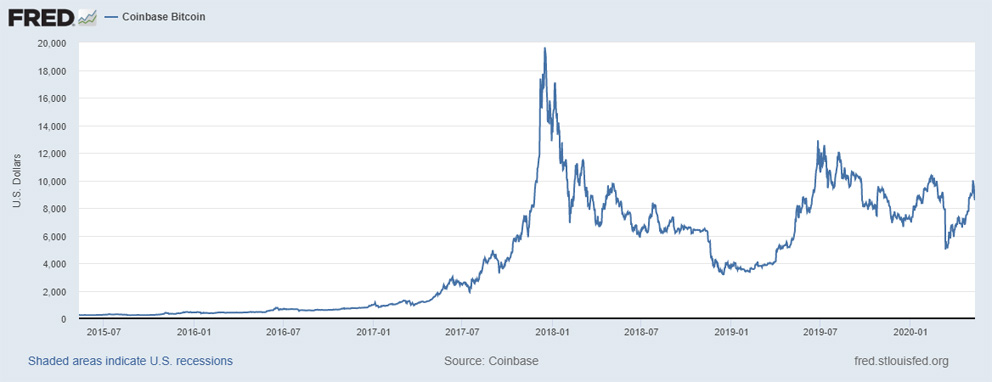

“First, the price had been rising steadily ahead of the highly anticipated event – almost three-fold in the last three months – and then dropped back just before and after it took place.

“This shows that there has been increasing retail demand for bitcoin as investors see and understand the growing influence and huge opportunities of digital currencies in an increasingly tech-driven world.”

Large cryptocurrency investors, known as ‘whales’, accumulate crypto at much lower prices then start a sell-off to capitalise on this sustained growing demand.

“Second, history teaches us that after this post-halving drop in price, there is a subsequent bull run,” Green added.

Previous bitcoin halving events have prompted impressive price climbs, the deVere CEO explained. The 2016 halving triggered a 300% jump in the value of bitcoin.

“There is no reason to believe this time the market will not respond with a longer-term upward trajectory,” Green said.

“Indeed, the rally which is likely on its way could potentially be even more dramatic because there is more mass awareness than ever before of the long-term use of and need for digital currencies.”

The deVere CEO added that in these unusual times, central banks have increased monetary supply and this will further drive prices of cryptocurrencies such as bitcoin.

“Traditional currencies are devalued and inflation fears rise on the back of the mass printing of money, the likes of which we have recently seen in the U.S., where the nation’s central bank (Federal Reserve) has added trillions of dollars to the money supply,” he said. Such measures will inevitably encourage even more investors to consider decentralised, non-sovereign digital currencies.

“Looking ahead beyond the halving event, cryptocurrencies are increasingly being regarded as the future of money due to the real-world issues they address and growing mass adoption,” Green concluded.