By Stefan Nolte

Prior to the coronavirus crisis, monetary systems were already headed for a systemic crisis.

Negative interest rates in Europe and minimal interest rates in the US (0% – 0,25%), in addition to the billions that had been injected into the markets with the goal of stabilisation (the real term should be “avoiding an economic downturn”), led to an average public and private global indebtedness of 245% GDP.

Conservative analysts believed that the stock markets were overheated by at least 25%.

Almost 50% of all US companies are over-indebted at a level that puts them only one step above junk bonds.

In January, a serious repo crisis blew up in the US and the Fed was not able to handle it until it pulled the emergency brake mid-March by throwing another $500 mln into the repo market.

How did they do that? They issued new Treasury Bonds and offset them against market liabilities.

Zero to negative interest rates constitute a vital problem for pension funds all over the world. Pension funds are crucial instruments to guarantee pensions.

Without this backstop for tens of millions of people, an already critical social situation would be far worse.

Thus, they are of systemic relevance and strictly ruled by applicable laws.

Pension fund investment strategies are highly regulated and limited, often stating that a minimum level of investment in government bonds must be maintained.

However, government bonds now bear zero to negative interest, making it impossible for pension funds to fulfil their duty to ensure the viability of ongoing social spending programs.

The pension fund of Norway is already in serious talks with the government to relax investment restrictions.

To make it clear; the risk here is the social stability of our entire (mainly) western society.

The financial turmoil did leave large institutional and individual investors irritated, and many chose to withdraw from various investments, keeping a good portion of their funds in cash in bank accounts.

For example, investors’ cash positions in Switzerland reached almost 30% as a result of recent financial events.

That is bad for the banks as well, as they cannot generate revenue from cash on account.

No matter how we look at it, the fiat financial system is growing weaker, and monetary authorities are reaching to ever more inventive methods of ‘stabilisation’.

Coronavirus

As everybody knows, governments in Europe, the US and other countries are trying to support businesses and to compensate at least a bit for the near-total shutdown of the real (physical) economy.

The lockdowns and curfews have caused exorbitant economic damage, and these measures may offer temporary relief.

Most retail businesses are closed, car producers and other industries stopped production, industrial supply chains are interrupted, and so on.

The International Labour Organisation (ILO) calculated that around 2 billion employees will either lose their jobs or have their income drop below the level that defines poverty.

The economic damage of the global air transport industry alone has been calculated to reach $4 bln.

It is crystal clear that the support programmes of governments will only be a tiny drop in an ocean of human misery, which may manifest in social unrest on a global scale.

The economy will not pick up rapidly after the virus has been mitigated, because people and companies lost substantial amounts of money and consumption will not increase to previous levels any time soon.

People are rightfully worried about their future and financial situation, and this well-placed worry will also keep the consumer-driven economy from anything close to a full recovery.

Increasing Demand in Gold

Both the systemic monetary problems and economic damage caused by the coronavirus measures increased the demand in gold to protect against losses in both the stock and money markets, as many people see it as a way to preserve wealth.

A good number of gold mines needed to stop activity to protect their workers.

The same goes for gold refineries, most importantly the gold refineries in Switzerland, which refine around 70% of the globally mined gold.

The transport of doré gold (pre-refined gold bars as produced by mines for transportation to refineries, typically with a gold purity of around 70-80%) as well as of refined fine gold bars became almost impossible.

The gold refineries in Switzerland re-opened two weeks ago with a workforce that was reduced by 50%, allowing them to produce around 30% of their normal capacity.

They are now producing orders from central banks and will start to deliver to the markets in about one to two weeks.

To compensate for substantial losses of funds from tumbling stock markets, institutional investors sold their gold futures contracts in a panic, which led to a temporary slide of the gold price between March 10-19.

After March 19, investors realised that gold is the only safe investment class in the long term and the gold price climbed to new records since October 2012.

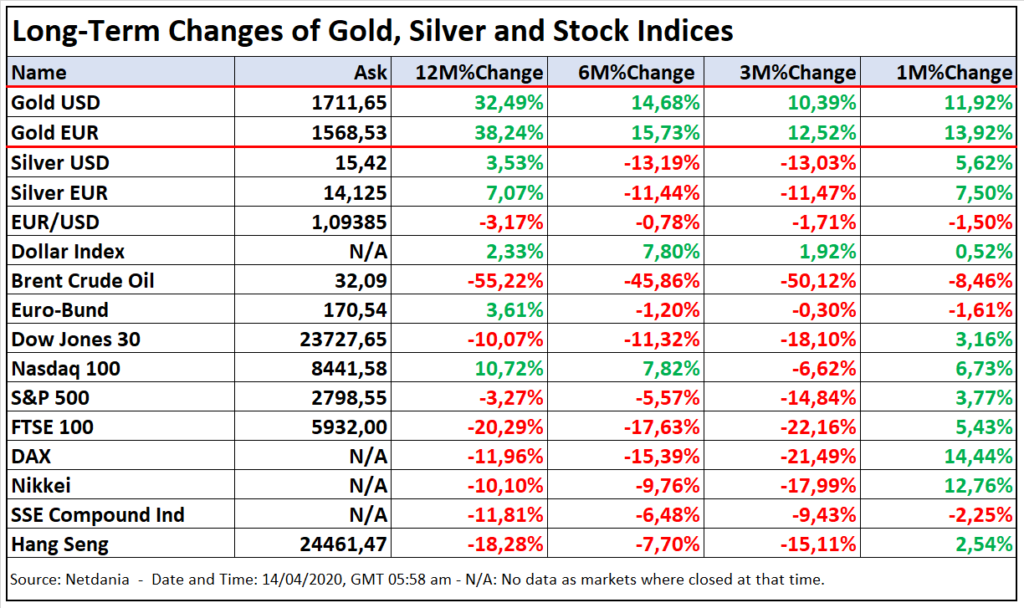

During the last 12 months, gold did indeed turn out to be one of the best ways to preserve wealth. Look at the chart below to see just how well gold performs when the financial world falls apart in spectacular fashion.

The S&P 500 is now worthless in gold terms than it was in 1971, and the Euro lost 84,3% of its value since inception in 1999.

Gold Price Surge

Analysts of large banks and investment funds expect the gold price to surge even further.

Analysts at Germany’s Commerzbank said we are “upwardly revising our forecast for the gold price at year’s end to $1,800 per troy ounce (from $1,650 previously).

This is based on the expectation that the global corona pandemic will be brought under control in the second half of the year and that the situation on the markets settles down accordingly.”

Peter Grosskopf, chief executive of asset manager at Sprott, sees, “gold over $2,000 sometime late this year or early next”.

“There is too much debt at all levels. We have borrowed from the future, and there is not enough economy to pay it down. That equation requires much more financial repression going forward, and gold is a great hiding place from that process.”

The world’s investors have become far too comfortable in the fiat monetary system.

As the global central banks continue to debase reserve currencies via the creation of vast amounts of new money, more and more people will be looking for golden parachutes.

Stefan Nolte is the Director of Liemeta ME Ltd, a provider of physical storage of precious metals at its prime location in Liechtenstein as well as trade services of precious metals, mainly gold, silver, platinum and palladium.

www.liemeta.com.cy