By Ivanka Pittelkau

Coronavirus fears hit the markets hards causing sharp declines in equity markets, plunging stock prices and even affecting the Fed.

On the other hand, investors have been flocking towards safe-haven assets such as Gold causing them to shine.

Memories of the SARS outbreak of 2003 have been haunting Asia since January 20, 2020 with infections topping 24,00 people and killing over 490.

At the time of the SARS virus, the price of gold price rallied 27% over the 12-months from March 2003 to March 2004. Gold, today, is already up 1.9% since the coronavirus outbreak.

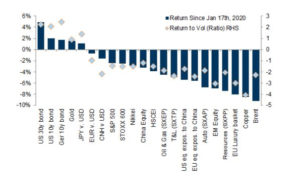

Chart 1: Overview of the Assets that have been hit hardest by Coronavirus concerns.

The outbreak of the coronavirus, originating in Wuhan, China, has resulted in investors’ concern over the recovery of global economic growth leaving an impact on stock markets, and boosting the demand for safe-haven assets.

Gold is considered a major investment option under market turmoil, and received a strong boost, reaching record levels on January 30, up 0.9% to US$ 1,590.70.

Gold has rallied 1.9% since the outbreak of the coronavirus.

Chart 2: Gold’s rally since the Coronavirus outbreak

Other countries have also reported confirmed cases following visits to China.

The epidemic comes at a very unfavourable time (not to say that there is ever a favourable time); not only was it Chinese New Year, but also in view of the ongoing trade war between the US and China in addition to general economic and geopolitical uncertainties.

Coronavirus is the biggest disease outbreak in China since the SARS pandemic of 2002 and 2003 in which more than 8,000 people were affected globally and 800 died.

Furthermore, the pandemic caused China’s GDP to shrink by 0.8%.

It is highly likely that the Chinese economy will remain no less effected than 18 years ago which will have a significant effect on global export demand and therefore delaying global economic recovery.

A worry that has been clouding the global economy for several months, in fact, years, a decade even maybe.

Are we looking at a perfect recipe for a global meltdown? Will this make a strong case for gold prices and other safe-haven assets to soar?

Last year, Ray Dalio predicted a “paradigm shift” for global investors towards gold.

The reasons for gold seem to be building up stronger day-by-day with the coronavirus further adding to uncertainties. Whilst there are a number of similarities between the coronavirus and the SARS outbreak, there is one thing that is different: China’s role in the economy is vastly bigger today.

So, any disruption will matter much more.

Additionally, and just as worrying is the easy monetary policies being pursued by several central banks including the US Federal Reserve.

The European Central Bank and the Bank of Japan have adopted a zero-interest-rate policy for more than a year. This is causing investors to park their money elsewhere than bank deposits and debt securities.

Lower interest rates decrease the opportunity cost of holding non-yielding bullion, making gold cheaper for investors holding other assets.

Furthermore, there are concerns of overvaluation of equities, chances of a no-deal Brexit, geopolitical unrest in the Middle East, all of which can lead to enhanced market fluctuations and changing investment patterns.

Investors will focus on precious metals as a store of wealth and hedge against market turmoil.

Central banks are also continuing their gold-buying spree.

Both of which result in this rally that we are currently witnessing.

According to industry veterans, the wealthy are stocking up on physical gold, as in bullion, coins and bars. It is, at this stage, therefore prudent to at least evaluate investing in physical gold.

Ivanka Pittelkau is Precious Metals Consultant at Liemeta ME Ltd