By Han Tan, Market Analyst at FXTM

Most Asian stocks are seeing out the week on a positive note, after the S&P 500 notched up a new record high. Despite the recent US and Iran airstrikes, risk appetite has been largely restored, with USDJPY advancing some 1.3% so far this week, while Gold has erased all of its gains to trade below the psychological $1550 level.

Investors have been emboldened by signs that both the US and Iran are backing away from the brink of an all-out conflict. The flare-up in the Middle East was the latest reminder for investors to remain vigilant over geopolitical risks. It remains to be seen whether this is merely a lull in what could be a protracted ‘action-reaction’ cycle between the US and Iran; such a scenario may still have to be factored into investors’ respective asset allocation strategies.

The diminished risks of a near-term escalation in the US-Iran conflict mean that market participants can refocus their attention on the US-China “phase one” trade deal which is set to be signed next week. The key detail will be the timing of the expected rollback in tariffs. The lowering of these barriers to trade, hopefully done sooner rather than later, should give the global economy more time to recover and provide cause for investors to add exposure to riskier assets, including those in emerging markets.

Positive surprise in US jobs data to spur Dollar

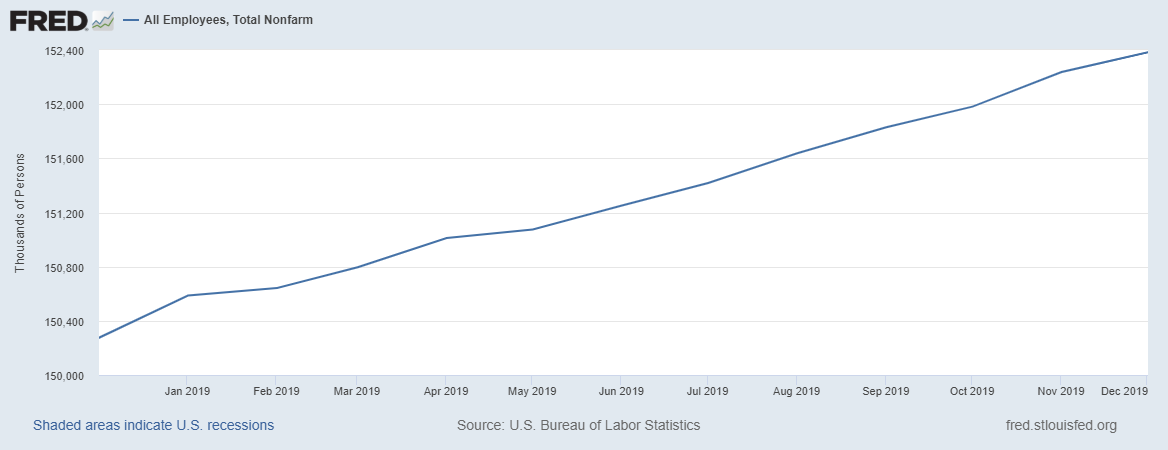

The Dollar index (DXY) has climbed one percent so far in 2020, trading around 97.40 in the lead up to the December non-farm payrolls (NFP) release, which came in at a gain of 145,000. Market consensus had been looking for a headline print of 160,000; such a figure would underscore the job market’s resilience as US consumers are being relied upon to maintain the growth momentum in the world’s largest economy.

The positive surprises in the headline number or in wage growth will see the Dollar index continue to rebound and push it higher towards its 200-day moving average at 97.70.

The positive surprises in the headline number or in wage growth will see the Dollar index continue to rebound and push it higher towards its 200-day moving average at 97.70.

However, considering that the DXY has been posting lower lows since October on the weekly chart, the US Dollar may find it tough to hang on to gains, as most analysts expect further softness over the medium-term, as long as risk-on sentiment remains uninterrupted and the Fed stands pat on US interest rates.

For information, disclaimer and risk warning note visit www.ForexTime.com

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius