By Lukman Otunuga, Senior Research Analyst at FXTM

The themes moving Oil prices in 2019 revolved around geopolitical tensions, the US-China trade war, oversupply fears and concerns over slowing global growth.

Despite all the conflicting forces, WTI Crude and Brent concluded the year on a positive note, gaining roughly 27% and 24%, respectively. Deeper production cuts by OPEC in Q4, combined with a ‘phase one’ trade deal between the world’s two largest energy consumers have brightened the outlook for Oil in 2020.

A renewed sense of optimism over the world economy bouncing back to life will certainly support ‘black gold’ moving forward. However, demand and supply side risks could still throw a proverbial ‘spanner in the works’ for bullish investors.

A renewed sense of optimism over the world economy bouncing back to life will certainly support ‘black gold’ moving forward. However, demand and supply side risks could still throw a proverbial ‘spanner in the works’ for bullish investors.

After the global economic storm, will there be sunshine?

Better than expected economic data from major economies should continue lifting fears over slowing world growth, ultimately boosting Oil prices.

Already, manufacturing surveys and reports on industrial production in the United States, China and India have started showing signs that the recent deceleration may be bottoming out. With over 40 central banks easing monetary policy in 2019, their efforts to revive growth may bear fruit next year as lower rates encourage consumption and investment across the globe. If there is truly economic sunshine in 2020 after prolonged periods of gloom before, this will provide a solid foundation for Oil to build on current gains.

Oil markets are not out of the woods yet

While the outlook for crude looks rosy amid US-China trade optimism, the commodity is certainly not out of the woods.

US Shale production remains robust with crude output reaching a record level of 12.9 million barrels per day. Fresh worries about excess supply may weaken Oil prices, especially if US Shale production continues to rise in 2020. On the demand side of the equation, growth in global demand in 2019 was the weakest in nearly a decade. The risk of rising supply and fears around falling demand could become themes that pressure Oil prices during the first quarter of 2020.

WTI Oil knocks on $61 door but is anyone home?

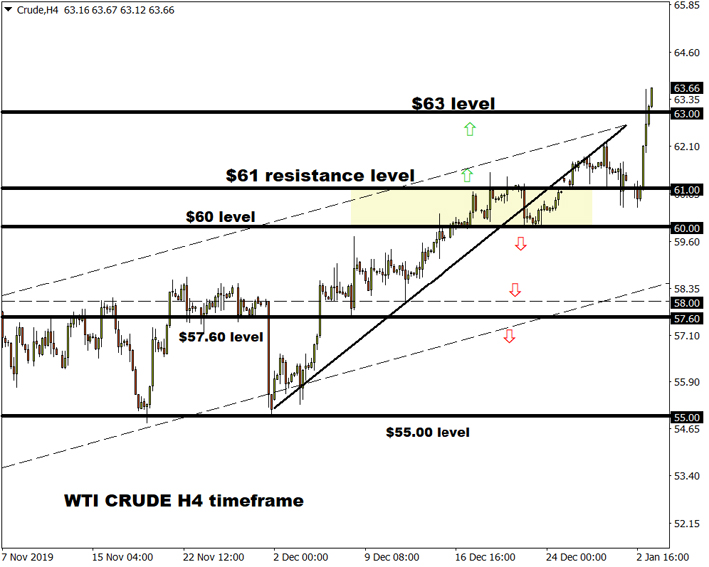

WTI Crude has been marching higher from the October low on the daily timeframe, with consistent higher highs and higher lows. A strong daily close above the $61 resistance level should encourage a move towards $61.40 and $62, levels not seen since September 2019.

While the outlook on the daily chart certainly points north, there is a strong resistance zone around $63.00 which may prove to be very stubborn. That said, more positive news on the trade front could result in prices pushing above $63 during the first trading quarter of 2020.

However, what goes up will eventually come down and this is no different for WTI Crude. Given how Oil prices remain highly sensitive to trade developments and global growth concerns, the downside potential must not be overlooked. Sustained weakness below $61 will invite a decline towards $60 and $58. If prices end up securing a monthly close below $57.60, then Oil could end the first quarter around $55.

For information, disclaimer and risk warning note visit www.ForexTime.com

FXTM Brand: ForexTime Limited is regulated by CySEC and licensed by the SA FSCA. Forextime UK Limited is authorised and regulated by the FCA, and Exinity Limited is regulated by the Financial Services Commission of Mauritius