By Naeem Aslam

The British Pound is having its best moments against the US dollar and other major currencies in over seven months as investors and traders have adapted to a new reality.

It was widely anticipated that the Bank of England would play an active role in saving the sinking economy of the UK.

However, the data from recent months and the speech from the Chancellor of Exchequer have made traders think that they need to start looking at the UK’s economy from a different perspective, as the country’s economic health has proven itself more resilient to the challenges that it faced.

The question that needs great attention to detail is if the UK’s economy is really resilient and if the Bank of England is only going to move its muscle twice this year with respect to interest rate cuts this year.

The UK’s economy has been facing monumental challenges over the past two years, and most of the injuries have been self-inflicted, such as the decision on Brexit, which ignited the massive fire under the inflation jets, and others, like its involvement in geopolitical tensions.

Investors and traders have been very cautious when it came to holding a more bullish view about the UK’s economy, as the main thought was that the UK’s economy was going to crumble due to the heightened tensions around the cost of living crisis.

It is not that the cost of living crisis threat is over; many families in the UK are under tremendous pressure and struggling with their daily life expenses, but the economic data has printed economic numbers such as GDP growth and consumer spending, which have been better than expected. This has given the Bank of England the confidence to rethink their strategy about their monetary policy and eased pressure on them in relation to interest rate cuts that we could potentially see this year.

Sterling and Interest Rates

The recent strength in the British Pound against the US Dollar has been due to two factors.

Firstly, earlier this year, or even during Q4 of last year, traders were expecting at least four interest rate cuts from the Bank of England in order to ease off the cost of living crisis and save the country from plunging into a deep recession.

Now the situation is different, and market players know that four interest rate hikes are out of the question for now, and the best possibility is more like three interest rate cuts, with the reality of two interest rate cuts more strongly on the cards.

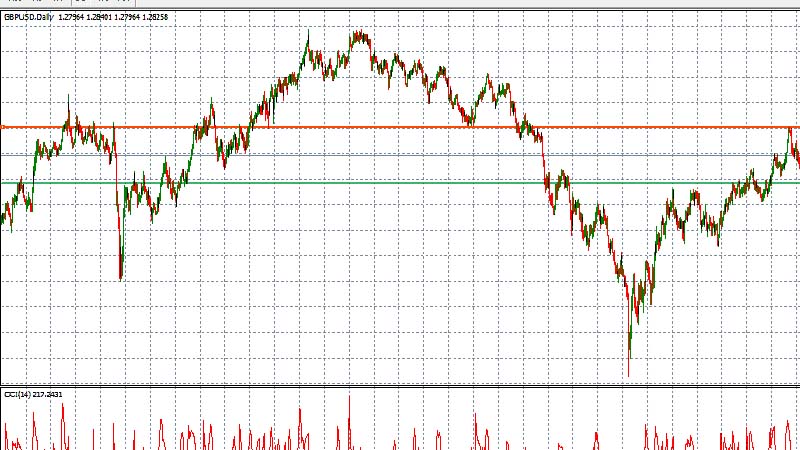

The second factor that pushed the GBP/USD pair to 1.28 is that, from the recent comments from the Fed Chairman, traders are now betting that the Fed is likely to do more interest rate cuts than the Bank of England as they are in a better position to ease off the burden.

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.

GBPUSD Chart by XTB

GBPUSD Chart by XTB