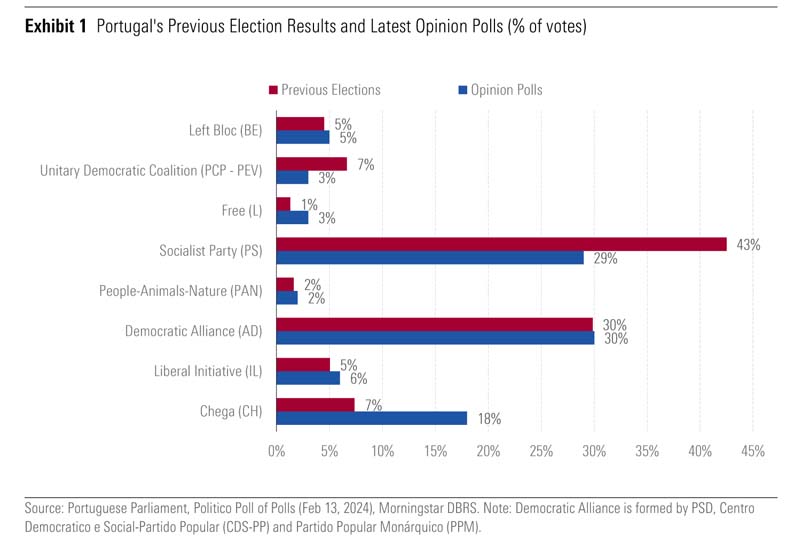

The latest opinion polls for Portugal’s parliamentary elections on March 10 suggest a tight race between two main centrist groups, the Socialist Party (PS) and the Democratic Alliance (AD) – a coalition of centre-right parties led by the Social Democratic Party (PSD).

According to Morningstar DBRS, neither is likely to achieve an absolute majority in parliament.

Chega’s rise in opinion polls could give them the opportunity to join a right-wing coalition led by AD or facilitate an AD minority government.

In any case, the rating agency does not expect the next government, whether led by AD or PS, to deviate from a decade-long commitment to prudent fiscal policy and debt reduction.

“The most immediate challenge for the next administration will remain the full and timely implementation of Portugal’s Recovery and Resilience Plan, especially in the context of a slowing economy and lurking geopolitical risks,” Morningstar DBRS said.

“In this sense, a prolonged period of negotiations to form a government or possible political instability could hinder the effective implementation of the plan.

Right parties gaining momentum

The electoral race is still open and both centrist groups could have a chance to form a government during the upcoming term, not least because there is still a significant share of undecided voters.

The latest opinion polls point to a tight race between the AD and the PS.

The PS’s popularity appears to have fallen sharply compared to the previous parliamentary election in 2022, when it won an absolute majority in parliament, while Chega’s popularity has more than doubled and the parties that make up AD are holding firm.

The most recent electoral test took place in the Autonomous Region of Azores at the beginning of February. AD won the regional elections but fell short of an absolute majority.

The most recent electoral test took place in the Autonomous Region of Azores at the beginning of February. AD won the regional elections but fell short of an absolute majority.

“There are no formal negotiations or public agreements between right-wing parties thus far, not least because significant developments are unlikely to occur until the national elections have passed,” the rating agency explained.

“The surge of far-right Chega in opinion polls has skewed political strategies and political debates before the regional and national elections.”

“Still, we do not consider that the prospect of Chega joining or providing parliamentary support to a potential AD led government would materially affect Portugal’s fiscal or economy policy as this will likely be dominated by AD,” Morningstar DBRS said.

Luís Montenegro, leader of AD, has publicly reaffirmed that a pact with Chega is off the table. However, political calculations may change after the elections.

The party leading the next administration will need to negotiate either a coalition agreement or support on a case-by-case basis.

“This might have different implications in terms of government durability and policy mix. Reaching broad political agreements could have marginal fiscals costs, although we do not expect them to be material enough to impact current ratings given the strong fiscal position currently,” the rating agency said.

Efforts to reduce public debt to remain unaffected

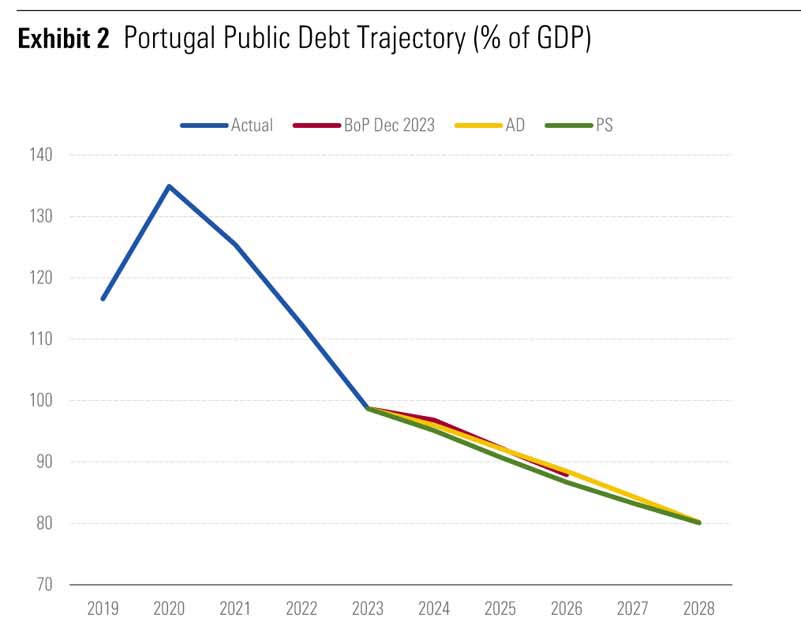

Portugal’s public finances have been improving rapidly since 2016, with a temporary reprieve triggered by the pandemic.

The public debt ratio amounted to 98.7% of GDP in 2023, below the 100% mark for the first time since 2009, and well below the 131.5% reached in 2016.

Portugal’s debt ratio is well below that of France, Belgium and Spain, and the European Commission projects this difference to widen in coming years.

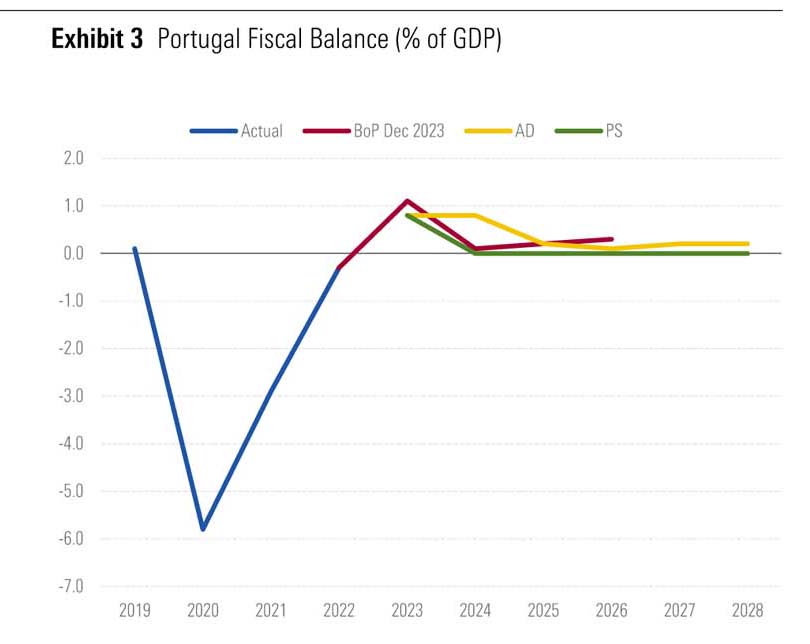

“The outgoing administration managed to pass a relatively expansionary budget for 2024 before the parliament was dissolved, providing broad policy continuity for 2024 in the face of a slowing economy. Still, Portugal should reach another surplus of 0.2% of GDP in 2024 after an estimated 0.8% for 2023, according to the draft budgetary plan,” Morningstar DBRS said.

“We expect Portugal’s commitment to sound fiscal policy and public debt reduction to continue, regardless of who wins.

“We expect Portugal’s commitment to sound fiscal policy and public debt reduction to continue, regardless of who wins.

“The main political parties, despite their policy discrepancies, agree on the importance of continuing to reduce the country’s public debt ratio from its high levels and to respect the fiscal rules agreed at the European level.

“Both the AD and the PS include similar public debt paths for 2024-2028 in their respective electoral programmes, very close to the Portuguese central bank projections in December 2023. If achieved, this would help Portugal reduce the vulnerabilities associated with its high public debt ratio, and leave it better place to face future shocks.”

The AD includes small fiscal surpluses, while PS assumes balanced budgets during the next legislature. The macroeconomic scenario from AD is more optimistic in the latter years, most likely reflecting their assumption that the proposed tax cuts will spur growth, the rating agency said.

Delays in Portugal’s RRP

Morningstar DBRS said that the most tangible near-term risk is a potential delay in the implementation of Portugal’s Recovery and Resilience Plan (RRP), especially if the formation of the government drags on over time or the next administration proves short-lived and triggers snap-elections relatively soon.

Thus far, Portugal has achieved 28% of the milestones and targets and spent 17% of the funds under its RRP.

“A prolonged period without a fully functioning government could cause delays in the implementation of the reforms committed in the plan. The successful absorption of EU funds is critical for Portugal to deliver long-term investments and to support companies and households at a time when economic growth decelerates.”

On another front, the plan from the outgoing administration to initiate the privatisation of TAP Air Portugal (TAP) was put on hold by the collapse of the government. The AD explicitly included privatisation in its electoral programme, while the PS refrained from mentioning it.

“Once the electoral campaigns and elections are over, we believe that the privatisation process is likely to restart again after a new government is formed.

“The reactivation of TAP’s privatisation process could provide another favourable boost to Portugal’s public debt reduction, however, we do not expect this to materially change the trajectory,” the rating agency concluded.