By Naeem Aslam

Friday’s biggest and most important economic report, the US NFP data, came much higher than expectations.

The price of gold was well on track to finish the week in negative territory and experienced a further sharp sell-off in the aftermath of the report.

After the US jobs report, the situation has become worse (in the short term) for gold, as it is more likely now that the price will post losses. All of this has taken place as investors remained very risk-averse throughout this week, which should have supported the gold price, but it didn’t.

To put matters into perspective, the US equity market is well on track to record the worst start to the year since 2008 as investors are trying to make sense of the next potential move by the Fed, and Friday’s economic report has huge relevance to both the equity players and gold traders.

Throughout the week, investors spent most of their time on the edge, as the US jobs market was the most important economic event of this week.

Investors have priced in a goldilocks scenario, which means that they have been expecting the US jobs market to print a number, which doesn’t show that the US jobs market is really strong, as that would make the Fed think that they can possibly increase the interest rate or keep the rates higher for longer.

The second theory before the data or gold traders wanted to see in the economic number wasn’t too much of a softness either, and this is because if the number had been too soft, it would have spurred fear and anxiety among investors about the possibility of the economy slowing down more than expected. This, in turn, would fuel the fire for a hard landing, which would have made traders more cautious.

Although a weak economic number usually triggers cautious behaviour among traders, it doesn’t always spur a rally in the gold price.

The US non-farm payrolls data printed a reading of 216,000, while the expectations were for 170,000, while the previous number was 199,000. The US unemployment rate fell further to 3.7%, while the consensus was for 3.8%.

What to make of the data

The data was stronger than expected, and the gold price has fallen on the back of the number as the dollar index strengthened. This is because traders are thinking that the rate cut may not take place that soon as the Fed has extra confidence in keeping the interest rate higher for longer.

Remember, the higher interest rate impacted the housing sector and the construction workers, but Friday’s number has shown that construction workers have found more jobs and the activity has ticked higher, which means that there may not be that much weakness in the market.

However, it is important to keep in mind that the market’s reaction in the first few hours usually fades as the dust begins to settle. The reality is that the Fed cannot afford to keep rates higher for longer, and I continue to think that a rate cut in the second quarter of this year is still on the cards.

Price action

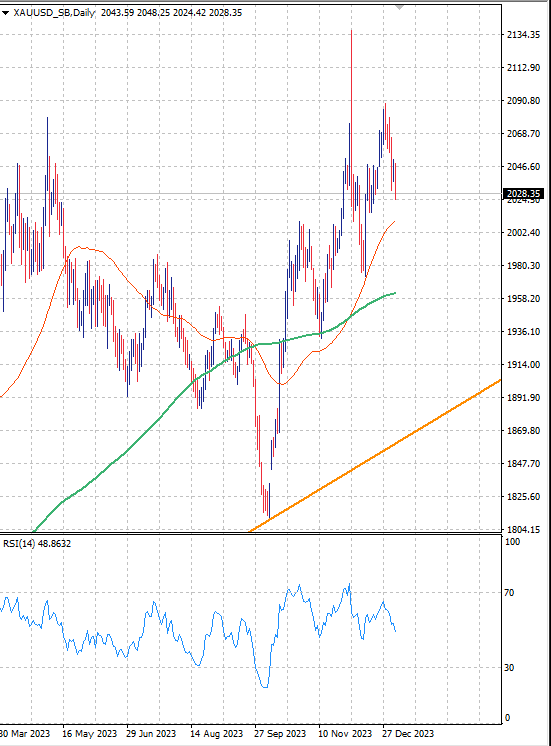

The gold price action has been interesting if one pays attention to the daily time frame. This is because the price has formed a clear higher highs and higher lows pattern, and the uptrend line has been very much intact when it comes to the gold price.

Gold traders have had their eyes attached to this uptrend line, as they have been waiting for a buy opportunity if the price begins flirting with this line. And Friday’s number has shown that the opportunity that they have been waiting for is finally here.

As for the important price points, there are two moving averages that I am very focused on: the 50-day SMA shown in red in the chart below and the 200-day SMA shown in green.

The 200-day SMA represents the long-term support, which currently sits at 1958, while the immediate to medium-term support is just near the 2010 price mark.

Gold trading price chart by XTB

Gold trading price chart by XTB

Naeem Aslam is Chief Investment Officer at Zaye Capital Markets.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Zaye Capital Markets.