By Theo Theodorou

There has been a complex relationship between the price of WTI crude and the US Dollar. Given that crude oil is denominated in USD, it was anticipated that a depreciation of the US Dollar would drive a rise in oil prices, while a strengthening of the US Dollar would correspondingly lead to a decline in crude oil prices. However, contrary to these conventional expectations, the dynamics between the two entities have taken an unexpected turn.

Numerous events have influenced the complex relationship between WTI crude and the US Dollar. Factors such as shifts regarding the supply and demand within the oil market, political turbulence and prevailing economic conditions have all contributed to the dynamic of this connection.

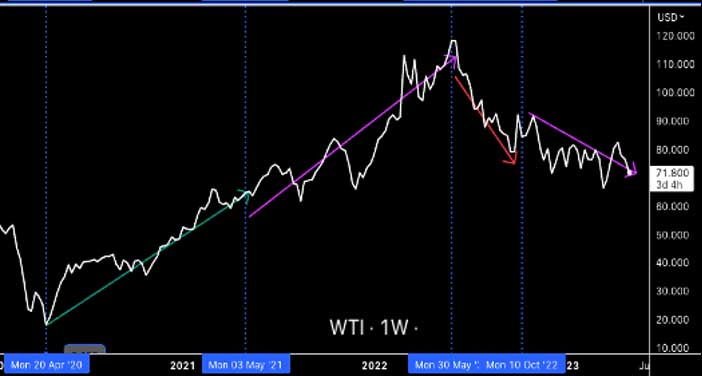

Charts 1a and 1b reveal the 5-year performance of the USD Index and WTI Crude Oil. Chart 2 reveals only the last 2 years’ performance of the US Dollar Index and the WTI. The bottom chart shows how WTI-crude moved over time.

Analysing these two charts in conjunction, a noteworthy occurrence unfolds during the height of the Covid-19 pandemic in April 2020.

In response to the current uncertainties, investors flocked towards the US Dollar, perceiving it as a safe-haven currency. This surge in demand caused a significant upturn in the value of the USD, subsequently triggering a substantial drop in the price of WTI crude. Remarkably, the WTI price dropped below the unprecedented threshold of $10 per barrel, only to swiftly rebound above $20 within a span of a single day.

From May 2020, both were moving as expected, meaning that the WTI rose in value with the USD depreciating. This lasted for eight months, until April 2021.

During this period, the value of WTI rose alongside the depreciation of the USD. This reveals that conditions changed, and the Covid-19 pandemic brought some conflict between the two.

Subsequently, between June 2022 and October 2022, the USD demonstrated ascendancy, while the WTI exhibited an anticipated drop in value. Lastly, from November 2022 until present, both the USD and WTI have undergone depreciation.

As the BRICS alliance began in June 2009, all five countries, Brazil, Russia, India, China and South Africa, joined by 2010. They aimed to increase the economy in their countries collectively.

BRICS and the shift of the global dynamic

In June 2023, BRICS reported that 19 countries are interested in joining. As Anjul Sooklal, South Africa’s ambassador, was quoted by Bloomberg as saying, “What will be discussed is the expansion of BRICS and the modalities of how this will happen. Thirteen countries have formally asked to join, and another six have asked informally. We are getting applications to join every day.”

Saudi Arabia, Iran, Argentina, UAE, Algeria, Egypt, Bahrain, Indonesia, and others have expressed their desire to partake. Some of these countries are significant parts of the OPEC organisation.

As the BRICS expressed the desire to ditch the US dollar and push back against America’s dominance, we may see a more complicated relationship emerging between the US Dollar and the WTI.

Theo Theodorou is a Global Educator and Financial Analyst at Admirals in Cyprus.

Theo hosts a series of free, live financial trading and investing webinars for trading clients to boost their skills and performance available at the Admirals Academy.