By Craig Erlam

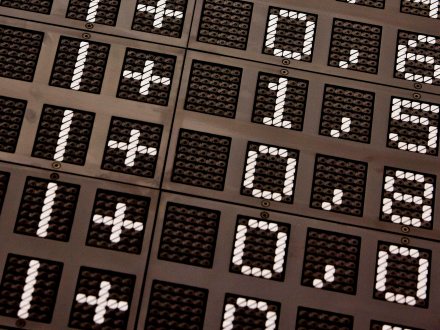

Equity markets are under some pressure on Thursday, with Asia mostly in the red and Europe poised to open almost a percentage point lower after the US Fed delivered a fourth consecutive 75 basis points rate rise on Wednesday.

This brought the benchmark federal funds rate to a range of 3.75% and 4.00%. The total of rate hikes for the year is now at 375 bps and they probably have a couple more rate increases in mind.

US stocks initially popped after the Federal Reserve provided enough hints that the end of the tightening cycle is nearing. Stocks could not hold up their gains as Fed Chair Jerome Powell reminded markets that inflation has been high for 18 months and that it is too early to think about pausing rate hikes.

Stocks might struggle as the risk of the Fed taking rates above 5.00% are still on the table.

The dovish part of the statement was that the Fed will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

The hawkish part of the statement was that they anticipate that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.

China’s Covid-zero saga

Chinese stocks were among the worst hit after the National Health Commission sought to quash rumours on social media that the country is studying ways to exit Covid-zero. That sparked a strong rally earlier this week which has only partly been reversed following the clarification.

Perhaps that’s a sign of how low stocks have fallen that investors are keen to jump back in on any bullish story, well-founded or not.

Fed gives with one hand, takes with the other

Just as investors believed they’d secured the dovish pivot they so craved, Chair Powell stepped up to deliver another crushing blow to the markets. That’s how it’s been perceived initially, but that could change once the dust settles.

The acknowledgment that future decisions will take into account cumulative tightening and policy lags was a strong nod to slowing the pace of tightening in December, barring some frankly terrible data in the interim.

That is exactly what investors wanted to hear. What they didn’t want was the claim that rates could go higher than they previously thought and they still have some way to go.

This is still net positive as a slower pace buys them time to see an improvement in the data and ease off the brake ensuring the least economic cost. That’s not to say a recession will be avoided, but maintaining 75bps makes that job much harder.

There are two jobs and inflation reports to come before the December meeting. By that time, things may look a little more promising and less uncertain.

BoE trying to catch up

The Bank of England will likely join the Fed in raising rates by 75bps later Thursday, to 3%. The central bank has had the unenviable job of fighting soaring inflation amid enormous economic and political uncertainty.

In recent months the country has had three Prime Ministers, three very different economic agendas, and no budgets outlining them. Not ideal for a central bank that’s fighting double-digit inflation.

It hasn’t handled things perfectly this year either. It’s taken a far more cautious approach than others leaving it in the situation now that it must raise rates aggressively and publish economic forecasts with little insight into government spending and tax plans.

Oil settling in a range

Oil prices are softening a little on Thursday after nudging higher again a day earlier. Brent appears to be settling around the mid-point of the $90-100 range as traders weigh up the impact of the OPEC+ cut against a bleak economic outlook.

The zero-Covid rumours in recent days may have given oil another bump higher, as will the crude inventory data that showed a large drawdown. But with those rumours not confirmed and recession talk growing louder, it may be a little premature to be suddenly optimistic.

Gold at week low

Gold bulls thought Christmas had come early on Wednesday when the Fed indicated a slower pace of tightening will be considered next month. But just as quickly as the good news was delivered, the caveat was yet another crushing blow.

The prospect of further tightening overall was enough to wipe out the benefits of lower hikes and gold now finds itself trading around the week’s lows.

Once the dust settles, will traders continue to view this so negatively? Slower tightening now buys time for the data to improve in a manner that could negate the need for more later, something 75 or 100bps hikes do not. This may not be bad news after all for gold. But traders may wait for some encouragement from the data before getting too excited again.

A crushing blow to bitcoin

Bitcoin also saw its hopes crushed as Powell took to the stage and spoiled the party. An initial rally to $20,800 was quickly wiped out and the sell-off didn’t stop there. Bitcoin ended the day lower, but managed to survive a run at $20,000. Whether it can hold above here will depend on Friday’s jobs data.

Another red-hot report could weigh heavily on risk appetite and see bitcoin slip back below $20,000 once more.

Craig Erlam is Senior Market Analyst, UK & EMEA at OANDA

Opinions are the author’s, not necessarily that of OANDA Global Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Losses can exceed investments.