From January to June 2022, the Federal Reserve increased the key policy rate by 150 basis points (bps) and GlobalData predicted that the Fed’s further rate hike of 75 bps in July will impact the 2022 economic growth projections for the US.

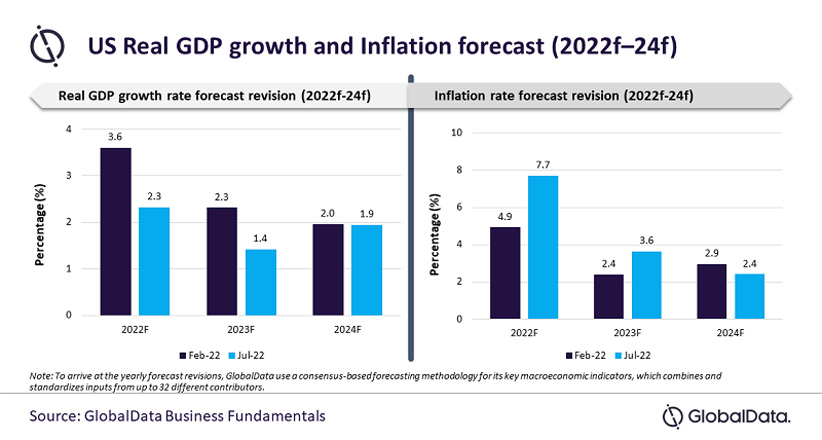

Consequently, the data and analytics company revised its predictions downward to 2.3% for July 2022, which is down from 3.6% in February 2022.

GlobalData also noted that the impact of the ongoing Russia-Ukraine war is expected to keep the inflation rate at elevated levels.

Accordingly, it revised its 2022 inflation rate forecast for the US upward to 7.7% in July 2022, from 4.9% in February 2022.

The US inflation rate rose to 9.1% in June 2022, up from 8.6% in May 2022, the highest level recorded since November 1981 and well above the Fed’s target of 2%.

In a bid to combat the soaring level of inflation in the US, the Fed rate was hiked by 75 bps in June 2022, by 50 bps in May 2022, and 25 bps in March 2022.

“As a result of the Federal Reserve deciding on whether there will be any further rate hikes, the US economy is expected to experience high borrowing costs for mortgages, credit cards, student debt, and car loans. Moreover, business loans are only expected to get more expensive,” said Bindi Patel, Economic Research Analyst at GlobalData.

Consumer behaviour

The rising prices has shifted consumer behaviour towards replacing discretionary items like electronics and apparel with essential items including food and fuel.

The change in consumer behaviour is expected to impact the market dynamics and slow down activities in various sectors due to reduced demand.

“If the inflation levels continue to rise and the Federal reserve undertakes an aggressive monetary policy stance, there is a downside risk that the US economy is likely to experience a recession in the coming months,” Patel concluded.

“Moreover, stock markets are likely to experience high levels of volatility especially within emerging and developing economies, as they continue to grapple with a continuous depreciation of local currency alongside high levels of inflation.”