Greek firm Energean is to acquire Total’s stake in Block 2, offshore Western Greece, providing further exploration opportunities in its core area of the Eastern Mediterranean with limited financial exposure.

The Israel and London-listed oil and gas firm said the deal enhances the future growth potential of its portfolio and medium-term optionality to deliver value to all of our stakeholders.

On completion, Energean would acquire France’s Total’s entire 50% Working Interest share and Operatorship.

Energean’s net remaining expenditure towards satisfaction of the minimum work obligation, which includes 1800km of 2D seismic acquisition and processing is approximately €0.5 mln.

“This is a highly attractive transaction in the context of the early stage prospectivity identified on the Block,” said Energean in a statement.

Work to date on the licence has identified that Block 2 contains part of a large, potential target comprising of a four-way closure at the Top Jurassic Apulia platform.

“The prospect is thought to be an analogue to the Vega field offshore Italy, in which Edison E&P operates with a 60% working interest.

The structure is covered by sparse 2D seismic which could be de-risked through the seismic programme that will be acquired as part of the minimum work programme.”

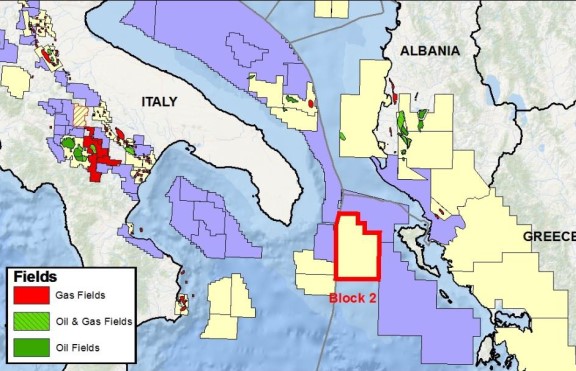

The feature straddles the Greek and Italian maritime border with approximately 60% of the prospect within the Block 2 license with the remaining area part in Italian waters.

Edison E&P, which Energean expects to acquire by mid-202o, as well as holding a 25% Working Interest in Block 2 also participates in the adjacent block offshore Italy, pending award.

Post completion of the Edison E&P transaction, Energean will then own a 75% Working Interest in Block 2. Hellenic Petroleum owns the remaining 25% Working Interest.

Energean is a London Premium Listed FTSE 250 and Tel Aviv 35 Listed E&P company with operations offshore Israel, Greece and the Adriatic.

In August 2017 the company received Israeli Government approval for the FDP for its flagship Karish-Tanin gas development project, where it intends to use the only FPSO in the Eastern Mediterranean to produce first gas in 2021.

Energean has offered to sell that gas to Cyprus via a purpose-built pipeline but Nicosia remains cold on the idea.

It has nine exploration licences offshore Israel, and a 25-year exploitation licence for the Katakolo offshore block in Western Greece.

On 4 July 2019, Energean announced the conditional acquisition of Edison E&P for $750 mln plus $100 mln of contingent consideration.

In October, Energean announced the conditional disposal of Edison E&P’s Norwegian and UK North Sea assets to Neptune Energy for $250 mln plus $30 mln of contingent consideration.